Solution for Franklin Templeton mutual fund

unitholders

Article

published as on Friday, 29th January, 2021 at 9:00 p.m.

As unitholder and investor of various schemes of this

mutual fund company we know that in April 2020 franklin Templeton announced

winding of its 6 debt schemes.

In May ,2020 SEBI gave permission to the franklin Templeton

mutual fund to list their schemes on stock exchange, what happened after that?

As it was winding up its schemes in the month of May SEBI

gave the permission of listing its units on stock exchange, so what happened now?

One concern raised that if it were to be listed on

stock exchanges than due to selling pressure investors won’t be able to realize

the true value of investment.

Even that was just a concern what really happened is

court cases and investor complaints. Now as the mutual fund AMC is stuck in

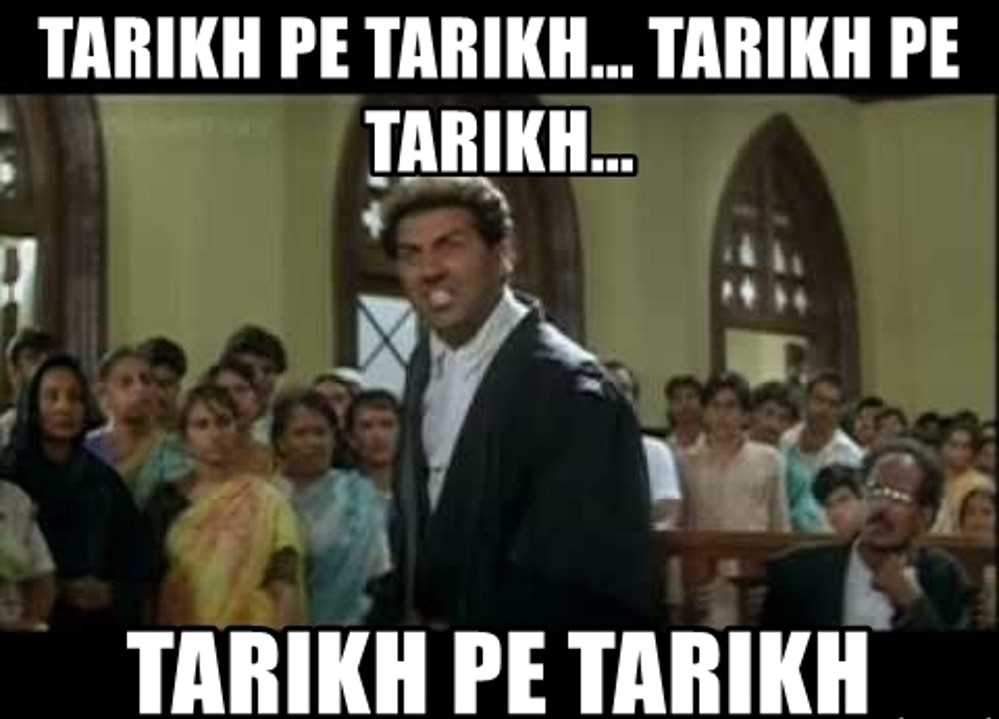

court cases it cannot do anything, only wait for next hearing date...

And even after so many dates what action has been

taken in interest of investors?

Next hearing is on 1st February in Supreme court

regarding irregularities in voting procedure.

Only ‘Tarikh pe Tarikh’ is going on.

Those investors who filled complaint in court may have

done with good intention but due to them thousand and lacs of other investors are

suffering with their money being stuck.

This is the case of apne pair pe kulhadi marna

On one side we have such investors who have created

road block not only for themselves but for thousands of other investors and on

other side we have franklin Templeton.

At least being a responsible mutual fund they should

have ensured that investors don’t suffer and have their schemes listed in stock

exchanges and give guarantee of buying units From open market if price trades below

5% of NAV in that manner it would have provided liquidity and relief to

unitholder and also ensure that those in need of fund don’t suffer huge loss.

(after all they have 8 to 9% yielding instruments in their

mutual schemes so it would be beneficial for the franklin Templeton also to

invest in them)

To conclude I would say that even if SEBI has to

intervene, SEBI should intervene and make sure to provide liquidity support to

franklin Templeton investors...

Money is safe in all these mutual funds schemes but if

it’s not accessible its useless...

Just like medicine provided after a patient dies is

useless

Liquidity not provided to investors on time is also

useless....

I have also written a mail to franklin Templeton with

a prayer of listing units of their schemes on stock exchanges so investors can

benefit with the liquidity, this is the best solution as on date.

I would end saying

Kabhi pyaase ko pani...

pilaya nahi.......

baad aamrut pilane se...

Kya faida?

Update:

The judgement

by supreme court is out and they have instructed Franklin Templeton to

distribute the surplus cash in each of their schemes within 20 days.

So, a major

relief is that investors are expected to get at least part payment before 21st

February, 2021.

Also note

for investor: Investors need to be cautious articles relating

to “60% haircut” given by CFMA (Chennai Financial Markets and

Accountability) several leading news websites such as times of India

and Moneylife are publishing their opinions and quoting

them this spreads misinformation and panic among investors.

Readers take

these opinions as facts and panic, CFMA has not explained the logic behind 60%

haircut and neither replied to my mail asking for logic behind this.

Investors

should visit for website of franklin

Templeton for detailed information on maturity of investments scheme wise.

ConversionConversion EmoticonEmoticon