Article published as on Wednesday, 11th

April, 2020 at 11:34 p.m.

Future group has been running its fixed deposit program since

start of 2019, so how come suddenly we are discussing on this topic again?

Well future enterprise has been sending mails, making people aware

of its FD scheme.

Future enterprise is approaching to small investors now, maybe

banks and other lenders are reluctant to lend more?

Situation has changed a lot since a year, Lets analyse the

current situation again.

Let’s start! With the 3 R’s first!

RETURNS

The returns are same as last years since it was launched. With

*additional 0.25% for Shareholders, Existing Employees, Senior

Citizen, Members of Future Group Customer Loyalty program viz. Future Pay, Big

Bazaar Profit Club, Easyday Saving Club *terms

and conditions apply

Returns of 9.00% for a year to 10.10% for 3 years

(11.60% on simple interest.

These returns are taxable as per individuals tax

slab.

RATINGS

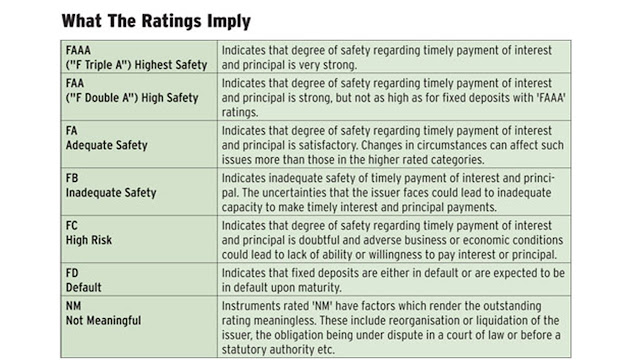

Future enterprise limited had published

advertisement in newspaper stating the rating of “ACUITE FAA” given by ’Acuité

Ratings & Research’

Subsequently received a revised letter

downgrading rating to

“ACUITE FA” (outlook under watch with

negative implications)

Ratings indicate high safety and low credit risk.

(following is an illustration of

rating structure)

|

The ratings may change over the period of time

and may not stay the same.

RISKS

People should know that the FD’s are unsecured,

now after the union budget BANK FD’s are secured up to INR 5 lakhs, corporate

FD’s which are issued by companies having net worth and turnover of at least

100 crores and 500 crores respectively are not fully secured.

Only INR 20,000 are secured in corporate FD in

case of default.

Also this amount shall be receivable after liquidation

and several rounds of appeals into IBC, MCA and courts.

Coming towards current situation after the

IL&FS, DHFL, ADAG defaults risk in unsecured corporate FD’s has increased.

Based on publicly available data future group’s

cash flow condition is bad, huge promoter holdings are pledged already, and

shares have halved in value within a month.

It is no secret that Kishore Biyani and his group

are passing through tough times, survival of future group with already so much

debt is going to be tough.

They are selling down their non-core business to

deleverage, if they are not able to execute it quickly things can go wrong

quickly.

FINAL VERDICT

As minimum amount of FD is INR 10,000 and maximum

secured amount in case of default is INR 20,000. For large investments it

becomes risky to invest in it. We have already seen red flags in this group due

to excess leverage, one must wait for further developments in

the situation.

If situation deteriorates one may lose

investment.

ConversionConversion EmoticonEmoticon