Srei infrastructure fraud or failure? What are

the facts?

Article published as

on Monday, 22nd February, 2021 at 7:00 a.m.

>Disclaimer:

This article is primarily for debt holders because if they

can't recover their money the equity is worthless unless there is some sort of

restructuring or merger & acquisition.

I will state links and sources of information wherever necessary.

The facts and figures provided are most

recent and from reliable data.

You shall take into account that

numbers will change over the time

Disclosure: I don’t own any NCDs from

Srei infra or Srei equipment, as of date.

>Introduction:

With the fiasco of IL&FS and

thereafter one after another DHFL, reliance ADAG (Reliance capital), future

group crisis and now this another major trouble with Srei Infrastructure is

slap on investors face.

As a part of shareholder awareness program, we would like to make investors of SREI infra aware of the facts!

The agenda of writing this article

is to present facts to investors about current status because there are

misleading articles and reports about massive fraud done by Srei, these are

exaggerated and are misguiding investors for example scamsbreaking.com

(international media corporation) from Sydney Australia reported that axis bank

has lent over 44,000 crores to Fraud hit Srei group.

I have searched the report online

but cannot find one, so I am just sharing it here

(Click here to download

report)

The report contains many misleading

facts, it’s just for reference!

These are exaggerated figures as its total loan book is between

30 to 35 thousand crores, so how can Axis bank have loan exposure of 44,000

crores to SREI?

So let’s understand realistically

how serious the issue is and how much recovery should an investor expect

realistically.

>RBI special audit:

The lenders of Srei group had a

dispute after Srei infra transferred some of its assets and liabilities in its

wholly-owned subsidiary Srei equipment, they allege that permission from all

creditors was not taken and demanded a forensic audit.

On 23rd November RBI announced to

conduct a Special audit of both SREI infra and SREI equipment finance by

appointing an auditor using its special power under sec 45 MA(3) of RBI Act

1934.

RBI conducts such special audit to

safeguard the investors and other stakeholders and when it feels the asset

quality has significantly worsened

>NCLT moratorium for 6 months:

A Kolkata bench of National

company law tribunal imposed a moratorium of 6 months from 1st January to 30th

June 2021 and said after which within 15 days all dues need to be paid.

Now also they have restricted categorizing any non-payments by

the SREI group as defaults by the rating agencies and also after the default of

payment no one is allowed to drag it into the IBC.

This is temporary protection given

to the SREI group, and also to prevent them from any litigation for non-payment.

>Quarterly results: December 2020 quarter

A few days ago the quarterly results

were announced by Srei infrastructure which was enough for any of its investors

to suffer a virtual heart attack or a trauma.

The December 2020 quarterly results

stated a massive consolidated loss of 3830.69 crores (link

here) while its net worth

stood at 4081.59 crores as of 30th September 2020 it’s now down to just 250.9

crores

To simply put: book value per share

has dropped from 81.13 rupees to just 4.98 rupees now.

>Capital structure:

Now the available information is taken from the annual report

of FY2020 and investor presentation of September 2020 so there are a lot of

changes that happened after this, but this is the best data to make accurate

assumptions.

Let us learn more about SREI infra’s

capital structure.

Srei infra liability structure:

The data from the annual report

(page 19) for the year ended 31st March 2020

Secured debentures 2,627 crores

Secured loans 25,295 crores

Unsecured loans 1,549 crores

Commercial papers 686 crores

Subordinated liability 2,848 crores

The secured debt comes to 27,922

crores that’s

84.6% of its 33,005 crores of total borrowings.

Now the data as on 30th September

2020 investor presentation

Total Borrowings 31435 crores

Domestic borrowings (bank) 59.49%

Securitisation & assignments 15.54%

NCD’s 13.27%

ECB & FC loans 7.40%

Domestic borrowings 4.30%

(Fi’s and others)

Commercial papers and ICD 0%

Total 100%

Here the secured component is 27757 crores or 88.3% out of the total borrowings

Against these the assets are

Interest earning assets 34,650 crores -Q3 loss (3830.69

crores)

(Excluding securitization)

Investments 1,563 crores

(Now in my personal opinion, the realizable value of investments

will be much lower because they are mainly in their subsidiaries and associates:

Srei equipment finance and Bharat Road network limited.

The realizable value for these investments could be 500 crores

on a conservative basis.)

After the Q3 the net

interest-earning assets seem to be around 30849.31 crores

>What if Srei Infrastructure goes into IBC?

What would the recovery be as per

the waterfall mechanism in case of liquidation and bankruptcy?

Waterfall mechanism as per sec.53 of Insolvency and bankruptcy

code

Priorities:

1st Insolvency resolution process

and cost for liquidation

2nd secured creditors and workmen

dues (up to 24 months)

3rd other employees dues (up to 12

months)

4th Financial debt of unsecured

creditors

5th any government dues and unpaid

dues of secured creditors

6th any other debts and dues

(operational creditors)

7th preference shareholder

8th equity shareholders (everything

that’s left, if at all)

Secured creditors are at the top of the list but the percentage

of secured creditors is high as well in this company.

And also this waterfall mechanism

doesn’t mean anything as we have seen in the case of Ruchi soya, Alok

industries where secured debt holder took up to 85% haircut and equity

shareholder saw share price multipy multifold times.

Also in the ongoing resolution of

DHFL, this waterfall mechanism had no relevance whatsoever.

Another risk’s in Srei

infrastructure is the quality of its loan book and how much of it is genuine.

We have seen DHFL Bandra books case

where more than 12000 crores were disbursed using a virtual Bandra branch with

the help of software, we don’t want that kind of surprise is waiting for us in case of Srei.

These were the facts about the case of Srei infrastructure.

Now, what should investors do?

*# this would be my personal opinion

#*

>What should investors do?

> What should debt (NCD’s) investors do?

Here is the link for checking the

ISIN code of issues debentures by:

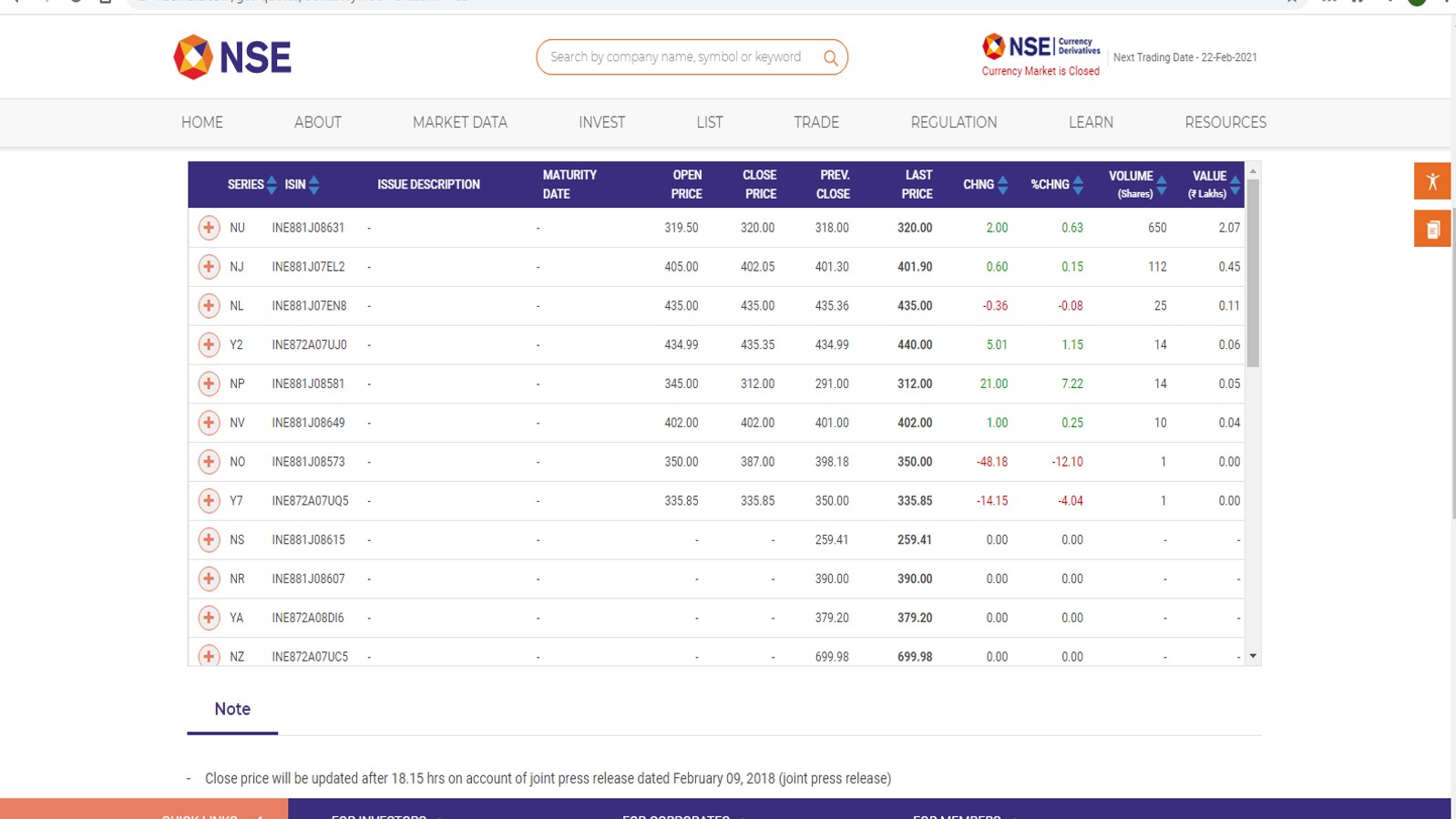

Now here is the screenshot of the prices of bonds trading on

exchanges as of 18th February 2020

|

Prices are so depressed, what should you do?

Hold it! Because you can probably

expect a similar recovery in the worst case if it goes into IBC.

And if everything in their business

gets back well and good you would recover all your principal as well, but

making a U-turn from this stage looks tough.

Axis trustee service and catalyst

trusteeship are debenture trustees depending upon your ISIN of NCD, in case of

any query you can contact them.

> What should equity investors do?

Time being it's best to hold the

equity shares as already we have seen value wiped out.

But don’t average! If the company does well and comes back on track you can recover your money, but it doesn’t and has to write off all of the equity then you’ll lose the new money you put in now as well.

>Comments on management:

I have seen some of the interviews of Hemant Kanoria, the management has experience of more than 30 years, in one video I have seen him with Sri Sri Ravi Shankar (link here)

In few other videos/interviews he often talks about how a business

failure should not be labeled as a fraud. Now it’s happening with his company,

is there fraud or failure?

Whatever the case may be the

ultimate thing is investors have lost money by trusting this company and that’s

a sign of failure… now if it’s a fraud in reality it will take some more time for the truth to come out to public, but the investigation for the same has already begun.

Now

(Link here ) at 11:00 to 12:40 minutes Hemant Kanoria is

heard saying not every businessmen who fail are frauds,

He has said this many times: this is

video link is just for reference.

It’s his time to prove it he and his

company is not a fraud by honouring all the interest and maturity payments of

debt holders and get the company back on track.

>Final comments:

As almost 60% of

its borrowings are through banks it’s highly likely they will restructure the

payment terms and keep the company a going concern. Otherwise, it would be

another NPA headache for banks.

In the worst case if it goes into IBC and takes 2-3 years for either resolution or liquidation the amount you are likely to get from the waterfall mechanism would be similar to current bond prices, so one should consider these points before taking decision On whether to hold sell these bonds.

>Update as on 8th October

Few revelations

Here is the disclosure given by SREI equipment finance for its NCD's on the NSE's website.

They say that their net asset coverage ratio has fallen to 45% but their gross coverage ratio is still 100%(Link here). They haven’t given this disclosure to exchanges for the main listed entity that is SREI infra.

Apart from this there is a 564 page pdf file containing all the financial statement of the SREI group, (page number 131 link here) Probable connected, related party transaction. Totalling up to Crores 8,575 are found.

Recently the Alternative investment Fund which was the connecting link in these “probable” related party transaction was sold off for 1.33 crores (circular dated 12th September link here)

These things were not disclosed until recently.

Similar another line of Business or a brand “Quippo”

I-Quippo was originally launched Srei Infra, then the control was transferred to the “Kanoria foundation” the current promoter entity of SREI group.

“Daal mai kuch kala nahi, puri ki puri daal hi kaali hai”

If SREI didn’t maintained transparency in disclosure and communication why would anyone trust them?

RBI is in hurry to put SREI into IBC because they simply don’t trust the promoters.

“SREI Company has in the past bided for assets & companies that were bankrupt.

Today SREI itself is facing Bankruptcy…”

Initially I felt that restructuring is a better option for SREI as opposed to taking it into the IBC.

But now based revelation of certain facts I understand he worry of banks and RBI, if Kanorias are let to run SREI for some more time, maybe they’ll siphon off more assets and in future the recovery percentage might even be lower.

Current situation is that based on the case of DHFL, our Reserve bank of India thinks a similar resolution could be worked for SREI by taking it into insolvency and bankruptcy court.

Looking at the Zeal of the RBI, it seems most probably by the end of this financial year the company would end up in the IBC.

5 comments

Click here for commentsGood analysis and information.

ReplyHope this company doesn't fail. Someone may buy it out.

I hope well experience will take the company into right direction and become profitable once. Any how your information is very precautionary.

ReplyYour analysis is quite good and informative.Please share us your opinion on OSPL hire charges,Deccan Chronicle holdings due payment,and the impact of merger of LVS Bank in which Srei invested some funds.

ReplyThank you...

ReplyThese are concerns for srei infra and for that reason conservatively 500 crore fair value has been taken for 1500 crore worth of investment.

ReplyIn the next quarter results we shall get more clarity on how much more provison they made for these bad investment.

And whats their overall position as a solvent entity.

ConversionConversion EmoticonEmoticon