Article published as on Monday, 21st September, 2020 at 7:30 a.m.

INDEX

Ø Understanding the Sector/Business.

~Overview of the SECTOR/BUSINESS.

~Current airlines operating in India and their market shares.

~Cut throat competition due to Low cost carriers (LCC).

~ Crude oil related risk and hedging.

Ø Narrowing down to 2 listed companies: Indigo & Spice jet.

~ Passenger load factor, fleet size and promoters.

~Financial ratios and Analysis and Interpretation of these ratios.

Ø Impact of Covid on quarterly profits of these 2 airlines.

Ø Conclusion.

~ Future of aviation sector positives and negatives

~pros and cons of both Indigo and spice jet

OVERVIEW OF THE SECTOR/BUSSINESS.

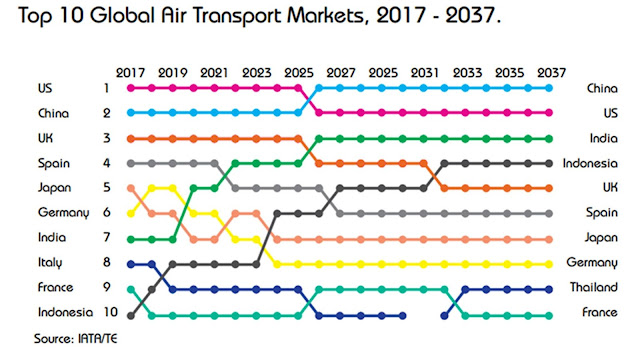

The aviation sector of India is the 3rd largest domestic aviation

Market in the world after the US and China and 5th internationally.

Current Indian airlines operating, their market shares in businesses.

Growth of Indian aviation, number of airports, UDAN (Ude Desh ka Aam Naagrik) scheme.

When it comes to aviation in India, it has come a long way from what it used to be in the past. The Airports Authority of India (AAI) manages 125 airports to date.

Air travel was not available to the masses due to the cost it bore. For this, the Government of India had released the Ude Desh Ka Aam Naagrik (UDAN) scheme in April 2017 which is a central and state government jointly and operates in phases.

The duration of this scheme is for 10 years and aims to connect the whole country aerially by bringing airports and other facilities to remote and hilly areas which are inaccessible, they also provide concessional ticket so everyone can afford to fly.

Cut throat Competition

A key issue driving the lack of profitability in the market is the cutthroat competition which comes as a result of the extreme dominance of the low-cost carriers in India, and this has lead kingfisher and jet airways into bankruptcy.

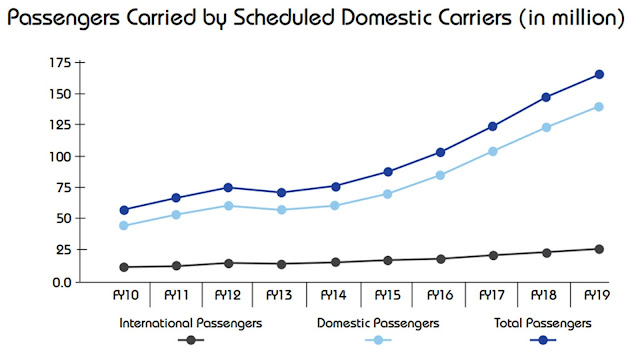

Indigo annual report mentions how in last 10 years Air fares have dropped 45%, and this is evident from the passenger traffic growth seen in same period.

Aviation sector is facing very tough competition and the cost environment too is not in their favour.

Full-service airlines are facing some difficulties while low-cost carriers (LCC) are doing a little better. Currently, India has two operational full-service carriers, Air India and Vistara.

A key issue driving the lack of profitability in the market is the cut throat competition which comes as a result of the extreme dominance of the low-cost carriers in India. India is the world’s 3rd largest aviation market for domestic traffic.

Over 87% of domestic market share belongs to the low-cost carriers. For comparison, in the US the LCC share is around 38%, while in Europe it is at 36.3%.

As per a study, the average hourly wage in the US as of June 2020 is around $30.34, while an average airfare as of May 2020 was at $427.75. This means that an average American need to work 14 hours in order to fund an average trip by plane. In India, however, the average domestic airfare is INR 5394 ($72.03), while the average wage is INR 180 ($2.40) per hour. This means that an average worker needs to work for 30 hours to take an average trip by plane, which is more than double as compared to the US.

Such extreme downward pressure on fare prices must lead to airlines offering extremely low fares as they compete for passengers, often selling tickets at a loss.

The underlying reason for the unprofitability of the Indian aviation industry is the low incomes of its citizens. That drives demand for low-cost travel, increases its market share and further increases the competition, keeping the fares low.

Furthermore, despite the extremely low fares, airlines in India face the same costs as airlines operating in any other market. They pay the same amounts for the aircraft they operate, for the fuel and for the maintenance.

In the end, the nature of the aviation market makes adjusting fixed and variable costs to the price levels of the fares impossible. That is the real issue leading to the competitiveness and unprofitability of the market in India.

Crude oil related risk to the Airlines.

Crude oil cost is one of the main costs for any airlines, apart from salaries, and Rentals of aircrafts.

While the other 2 cost are fixed and predetermined, the cost of crude oil can’t be controlled.

Generally, whenever price of crude oil falls the profits increase, this time around April the crude prices were at rock bottom levels, yet there are no expectations of rise in profits due to the black swan even called pandemic.

Solution to this problem: Fuel Hedging

Many airlines use hedging to mitigate the risk of fuel price volatility. Fuel hedging means an airline agrees to purchase a certain amount of oil in the future at a predetermined price. The limitation of hedging is that they can hedge for 2 to 3 months of required oil, and again if price increase, they become helpless.

NARROWING DOWN TO 2 LISTED COMPANIES.

Passenger load factor

Passenger load factor is the capacity utilization number used by airline industry, its calculated using = seats booked/ total available seats.

INDIGO

Passenger load factor of INDIGO drops to 60.7% due to the pandemic wherein it was difficult for them to fill up seats and the flights took off with not even 25% of the passengers.

Passenger Load Factor data was reported at 83.106 % in Oct 2019. This records an increase from the previous number of 82.703 % for Sep 2018.

SPICEJET

Passenger load factor of SPICEJET drops to 68% due to COVID-19.

Passenger Load Factor data was reported at 90.00 % in Oct 2019. This records an increase from the previous number of 87.365 % for Sep 2018.

Fleet size

Indigo has a fleet size of 276 aircrafts whereas the SpiceJet has a fleet size of 120 aircrafts.

Promoters and Investors

Indigo

Indigo was promoted by Rahul Bhatia and Rakesh Gangwal in 2006, from just 1 aircraft they have grown to currently 270+ aircrafts… showing their capabilities, recently they were in news highlighting problems in corporate governance. This is a concern.

They currently on a combined basis own 74.86% share.

SpiceJet

SpiceJet is currently owned by Ajay Singh, before he became the promoter and CEO the airline was on the verge of bankruptcy in 2014, he bought the stake from Kalinathan Maran.

He is credited with the turnaround success of the airline. Also, there is no adverse background related to the promoter right now.

The promoter holds 59.93% stake right now.

(Promoter holding as on June quarter 2020).

Financial Ratios and Figures,

Indigo

|

FY15

|

FY16

|

FY17

|

FY18

|

FY19

| |

Operational ratios

| ||||||

1

|

Fixed asset turnover ratio.

|

0.81

|

0.87

|

1.14

|

1.45

|

1.47

|

2

|

Working capital turnover ratio.

|

65.39

|

8.64

|

4.15

|

2.82

|

2.95

|

3

|

Total asset turnover ratio.

|

1.33

|

1.32

|

1.27

|

1.13

|

1.19

|

4

|

Debtor turnover in days.

|

9.87

|

11.47

|

11.90

|

11.73

|

14.41

|

5

|

Creditor turnover in days.

|

44.30

|

53.33

|

57.13

|

54.05

|

60.11

|

Leverage ratios

| ||||||

1

|

Interest coverage ratio.

|

12.29

|

8.14

|

9.46

|

102.01

|

7.07

|

2

|

Debt equity ratio.

|

24.60

|

3.63

|

3.02

|

1.99

|

2.60

|

3

|

Debt asset ratio.

|

0.96

|

0.78

|

0.75

|

0.67

|

0.72

|

Profitability ratios

| ||||||

1

|

EBITDA margin (in %).

|

12.02

|

17.61

|

18.76

|

16.29

|

3.69

|

2

|

PAT margin (in %).

|

9.11

|

11.93

|

8.57

|

9.36

|

0.52

|

3

|

ROE (in %).

|

310.00

|

72.94

|

43.90

|

31.68

|

2.25

|

4

|

ROA (in %).

|

0.13

|

0.17

|

0.12

|

0.12

|

0.01

|

5

|

ROCE (in %).

|

18.16

|

27.69

|

30.00

|

23.10

|

2.12

|

SpiceJet

|

FY15

|

FY16

|

FY17

|

FY18

|

FY19

| |

Operational ratios

| ||||||

1

|

Fixed asset turnover ratio.

|

0.75

|

0.78

|

0.97

|

1.22

|

1.44

|

2

|

Working capital turnover ratio.

|

-2.81

|

-2.68

|

-3.82

|

-3.60

|

-4.06

|

3

|

Total asset turnover ratio.

|

2.06

|

1.83

|

2.10

|

1.94

|

1.91

|

4

|

Debtor turnover in days.

|

37.63

|

23.09

|

12.24

|

13.69

|

17.55

|

5

|

Creditor turnover in days.

|

279.70

|

242.19

|

151.96

|

118.58

|

138.46

|

Leverage ratios

| ||||||

1

|

Interest coverage ratio.

|

-3.70

|

3.95

|

6.53

|

6.57

|

-1.58

|

2

|

Debt equity ratio.

|

-0.89

|

-0.88

|

-1.27

|

-15.14

|

-1.58

|

3

|

Debt asset ratio.

|

1.49

|

1.36

|

1.20

|

1.01

|

1.07

|

Profitability ratio

| ||||||

1

|

EBITDA margin (in %).

|

-8.88

|

12.81

|

9.94

|

10.68

|

0.53

|

2

|

PAT margin (in %).

|

-12.77

|

8.62

|

6.87

|

7.23

|

-3.45

|

3

|

ROE (in %).

|

54.33

|

-43.30

|

-70.72

|

-1318.81

|

90.13

|

4

|

ROA (in %).

|

-0.25

|

0.16

|

0.15

|

0.16

|

-0.07

|

5

|

ROCE (in %).

|

-940.66

|

220.83

|

81.12

|

64.81

|

-17.72

|

Analysis of the ratios..

RATIOS

|

Indigo

|

SpiceJet

|

Operational ratios

| ||

1) 1)Fixed asset Turnover ratio

|

In indigo the fixed asset turnover ratio increased from 0.87 to 1.47 times indicating efficient use of its fixed assets and moving towards asset light model.

This can be attributed to not owning more aircrafts and instead taking them on lease thus providing flexibility to the company, also at the same time increasing sales without taking much of debt.

|

The company has an asset turnover of 0.75 in the year 2015. the company had made some announcements in 2015 regarding the improvements for the revenue and growth and the measures were improving loads and yield

increased close-in pricing

– optimized customer mix

– innovative fare structures to maximize revenues and at the same time provide value to the consumer

– increased international presence

These were some measures which company used, the results of this can be seen in upcoming years as the ratio increased to 0.78 in the year 2016 and to 1.44 in the 2019 there has been a good amount of change over the years

|

2) 2)Working capital turnover ratio

|

This ratio has been in decreasing trend indicating high working capital maintained by the company, this is mainly due to huge current assets it holds.

This when compared to spice jet seems odd, as spice jet uses negative working capital that means it runs business on borrowed funds, whereas in Indigo this ratio indicates inefficient use of cash and bank balance of its balance sheet.

|

The working capital turnover ratio if compared from the 2015 to 2019 it has been increasing consistently this shows the quality of the management that how efficiently it is using its capital to support sales this also shows the goods operations but in the 2018 and 2019 the results of the income with revenue was not that promising as it was earlier the company still needs to figure out how to used their working capital in a more effective way but we can also give a counter view that the prices of the raw material has also caused a negative effect on the company. The working capital ratio of this company is not high because a high ratio indicates that the company business does not have enough capital to support its sales growth.

|

3) 3)Total asset turnover ratio

|

This has decreased from 1.33 to 1.19 times indicating deteriorating efficiency in use of its assets, this is mainly due to account of huge cash and current assets balance.

|

This ratio tells us the efficiency with which a company uses its assets to produce sales the companies asset turnover ratios is 2.06 in 2015 and 2.07 in 2017 in and there was a little slowdown in 2016 which took the ratio to 1.86 and in 2019 the ratio stood at 1.91

|

4) 4)Debtor turnover in days

|

This has increased from 9.87 to 14.41 days indicating higher revenue from credit sales. Which is not an encouraging sign, but if we look purely on the basis on number of days 14 days is still very short compared to other manufacturing companies

|

The debtor’s turnover ratio has decreased from 37.63 to 13.6 in FY18. It again increased in FY19 standing at 17.55. Which indicates faster collection and efficiency.

|

5) 5)Creditor turnover in days

|

This ratio indicates how long the company is able to get credit from suppliers. This has increased from 44.30 to 60.11 days indicating better bargaining power.

|

The creditor’s turnover ratio of the company has gradually decreased except in the FY 19. It has decreased from 279.7 to 118.58s indicating stricter payment terms with creditors.

|

Leverage ratios

| ||

1)Interest coverage ratio

|

As we can see EBITDA margin has fallen still in FY19 the company has ratio of 7.07 indicating very little interest payment which is encouraging sign.

Indigo has maintained healthy levels of interest coverage mainly in the range of 6 to 12 times. FY18 was an exception with 102 times.

|

In the FY15 the company had a negative interest coverage ratio of 3.7 times. This is because the EBIT for the year was also negative. The ratio for FY16, FY17 & FY18 are positive and are good in numbers because the EBIT has increased year on year and also the finance cost has decreased. Also, the ratio was high in the FY18 compared to all the years at 6.57. In the FY19 the ratio was negative 1.58 times indicating tough time for aviation industry.

|

2)Debt equity ratio

|

Ratio has fallen from 24+ times in FY15 and Suddenly from FY16 onwards this ratio has fallen below 4 times and in FY19 its 2.60 times that can be attributed to the IPO proceedings which was done in FY16 which helped reduce its debt equity significantly.

|

The debt equity ratio is negative throughout the years because of negative net worth it has been -3.96 times in FY15 and has moved towards -94.83 times in FY19 which is good, this is because the negative equity closer to becoming positive but as we know FY20 was a bad year this ratio would have again deteriorated.

|

3)Debt asset ratio

|

This is similar to debt equity ratio, lower means lesser debt proportion and we can see it has decreased from 0.96 to 0.72 indicating lesser assets funded by debt.

|

The company throughout the years, most of the assets of the company are financed through debt. In the FY15 the ratio was 1.34 and for FY19 was 1.01 this indicates that for every rupee of asset it has it owns 1.34 and 1.01 rupees of debt respectively.

|

Profitability ratios

| ||

1)EBITDA margin

|

This has been in the range of 12% to 19% with FY19 being an exception with 3.69% margin, this was a tough year for aviation industry as a whole.

It is observed that Indigo has performed consistently in all these years owning to its prudent management, and financial discipline.

|

The ratio has been increasing from 2014 on words, where 2015 was its best performance. It can observe that the company has steadily increased its EBITDA up until 2018 despite suffering huge losses in 2014 and 2015. The EBITDA have been the highest in 2018. Spice jet was able to decrease its operational expenses in 2015 but since then it has been climbing, although the company has been able to increase its sales and decrease the effect of the increasing operational expenses through the years. The company has recorded the highest revenue it earned in 2019.

|

2) PAT margin

|

These have also been in range of 9% to 12% with FY19 being an exception with 0.52% as margin.

These margins again show the financial discipline of the management and ability to steer the airline in tough times.

|

It can be observed that the ratios performance has been fluctuant with an increase in 2015 and 2017. The company has been decreasing its interest payments from 2014-2018 but has spike in 2018 and 2019. In 2019, despite reporting the highest revenue recorded in the 5 years period the company could not convert these revenues into profits due to poor cost management

|

3) return on equity

|

This ratio was 310% in FY15 due to its extremely low equity base, in the following years it has been decreasing indicating deteriorating returns generation capability. Going forward the ability to generate

|

It can be observed that the ratio has been fluctuant in nature and has not really improved. Compared to its peer indigo the company has very poorly performed to increase the net worth of the company. Even though the company has a positive ratio in 2019 it can be misleading because both the net worth and PAT were negative.

|

4) Return on assets

|

This ratio takes into account assets, thus indication how efficient overall the resources are being used this has stayed in the range of 0.12% to 0.17% with FY19 being an exception. If the company managed it cash and bank balance well it could have improved this ratio as well.

|

The company has kept a steady performance in this ratio up until 2018. In 2019 the ratio drops to 0.07%. It can be seen that the company as decreased its assets by 19% compared to 2018. The company has made significant decrease in short term investments and severe drop in liquidity can be seen as the reason in the drop in % increase in assets and decrease in PAT which has caused the ratio to decrease.

|

5) return on capital employed

|

This ratio is similar to ROA just that current assets are excluded so we get capital employed. This shows that the company has been generating return on capital in the range of 18% to 30% which Is good, now again here FY19 is exception with just 2.12%

|

The Ratio had hit its peak in 2016 where both the PAT and Capital employed fig have increased significantly. Since 2016 the figure has been dropping due to the fall in capital employed. In 2019 the company was giving negative returns as PAT had fallen drastically. It has no consistency in this Ratio as we can see Zigzag trend in it.

|

.

Future of Aviation industry in India

According to some reports ‘India is the graveyard of aviation companies’ and this has been true as many regional airlines have totally disappeared from the competition and only a handful names are remaining.

It was already a challenging sector and now with the added financial stress post pandemic without financial assistance there is possibility of another airline going bankrupt.

Rays of hope for Aviation industry

At least one airline has to survive, with the bankruptcy of jet airways last year, other airlines enjoyed higher profitability due to passenger traffic growth, hence with more consolidation, the profitability and chances of survival will increase.

Cargo segment, even in this pandemic scenario where passenger traffic was muted the cargo segment was operational and doing well.

Spice jet and indigo both have developed this segment and have entered into aviation logistics. This diversification may help.

Favourable policies, many countries such as Italy, Switzerland are dependent on tourism industry and hence the government shall propose favourable terms to tourist thereby increasing tourism and air traffic.

Negatives:

Airlines are under financial stress... And till now Indian government has shown no sympathy towards them, in fact government is looking themselves to sell off their own air India.

Future looks dark as in India the low-cost carriers are dominant and due to the crisis, the earning and savings have reduced drastically, people may not prefer to travel for business meets and instead use online apps, for discretionary spends people may choose to delay the spends.

Also, its estimated global aviation industry was estimated to have a revenue of 872 Billion dollars in revenue in 2020 and now its 419 billion dollars, and its estimated that the sector may not get back to pre-Covid days anytime sooner than 2023 or even 2025.

Let’s get into detailed pros and cons of both the airlines.

Indigo

|

SpiceJet

|

Pros

|

Pros

|

Indigo is largest player in aviation industry just like Jio in telecom, this company is leader in aviation promoter stake is high at 74%+ which shows high amount of confidence in the company.

|

Ajay Singh holds almost 60% in the airlines. Ajay Singh seems a visionary, he has turned around the loss-making airlines back into profitability.

|

Huge market capitalization, this will help in case of future fund raising, (currently it has raised money through rights issue)

|

He has major stake in airlines, it is in his best interest to keep airline alive and going, they shall do their best to make the airlines survive after Covid.

|

Strong balance sheet compared to other companies, huge amount of liquid cash on balance sheet.

| |

Cons

|

Cons

|

Issues relating to lapses in corporate governance (allegation of related party transaction) is a concern.

|

Spice jet is currently into deep financial stress, auditors have expressed their concerns on the airlines as a going concern.

|

Posted loss in fy20, after 10 years of continuous profitability.

Valuations multiples are high.

|

Unless they raise funds (which would dilute promoter stake) the survival of spice jet seems tough.

|

Most likely next candidate for bankruptcy.

|

(pdf download link to our presentation click here )

Bibliography

www.economictimes.indiatimes.com

ConversionConversion EmoticonEmoticon