Gold vs

platinum in investing

Article published as on Thursday, 17th September, 2020 at 10:00 a.m.

|

properties |

Gold |

platinum |

|

Colour |

Gold/yellow |

Metallic

greyish white |

|

density |

19.3

grams/cm3 |

21.45

grams/cm3 |

|

Melting point (Celsius) |

1064 |

1768.3 |

|

Boiling point (Celsius) |

2700 |

3825 |

|

Hardness |

2.5 |

4.5 |

|

Malleability (ounce: 28.35 grams) |

300

(sq.

ft.) |

99.19

(sq.

ft. ) |

|

Ductility (1 gram) |

2.4

km |

16.5

km ( source) |

|

Price

per ounce (31.11 grams) (29/8/20

USD INR: 73.13) |

1940 $ |

940.70 |

|

Annual

production (mined) |

Gold |

platinum |

|

2017 |

3494

MT |

173.64

MT |

|

2018 |

3556

MT |

173.50

MT |

|

2019 |

3531

MT |

172.77

MT |

Interesting stats on

gold hub

SUPPLY & DEMAND ANALYSIS

|

GOLD |

supply |

in MT |

|

|

||

|

||||||

|

year |

mined |

recycled |

total |

LMBA price / USD once |

||

|

2015 |

3336.3 |

1103.4 |

4440 |

1160 |

|

|

|

2016 |

3459.7 |

1263.5 |

4723 |

1251 |

|

|

|

2017 |

3493.6 |

1140.1 |

4634 |

1257 |

|

|

|

2018 |

3556.0 |

1160.1 |

4716 |

1268 |

|

|

|

2019 |

3530.9 |

1296.2 |

4827 |

1393 |

|

|

|

GOLD |

demand

|

in MT |

||||

|

year |

jewellery |

technology |

investment |

central

bank |

total |

|

|

2015 |

2459.8 |

331.7 |

962.3 |

579.6 |

4333 |

|

|

2016 |

2103.9 |

323.0 |

1614.6 |

394.9 |

4436 |

|

|

2017 |

2242.3 |

332.6 |

1315.8 |

378.6 |

4269 |

|

|

2018 |

2248.4 |

348.8 |

1165.2 |

656.6 |

4419 |

|

|

2019 |

2122.6 |

326.0 |

1273.4 |

667.7 |

4390 |

|

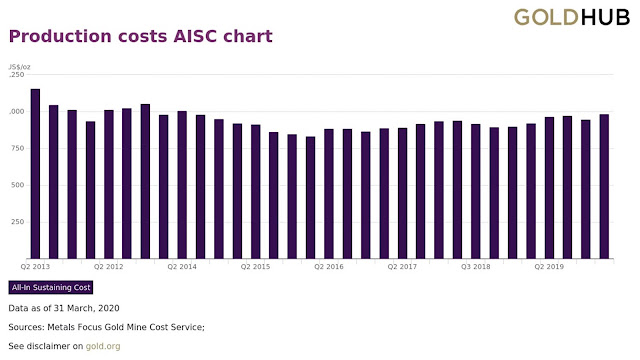

Here we can see the all in sustaining production cost of gold is in the range of 800$ to 950$ range for last 5 years, serving as an incentive for gold miners.

|

platinum |

supply |

in MT |

|

||||||

|

year |

mined |

recycled |

total |

|

|||||

|

2015 |

174.63 |

48.34 |

222.97 |

|

|||||

|

2016 |

171.09 |

52.16 |

223.25 |

|

|||||

|

2017 |

173.64 |

53.58 |

227.22 |

|

|||||

|

2018 |

173.50 |

54.71 |

228.21 |

|

|||||

|

2019 |

172.77 |

61.38 |

234.15 |

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

platinum |

Demand |

in MT |

|||||||

|

year |

automotive |

jewellery |

industrial |

investment |

total |

||||

|

2015 |

95.40 |

80.51 |

47.77 |

8.65 |

232.32 |

||||

|

2016 |

97.95 |

71.02 |

50.75 |

15.17 |

234.88 |

||||

|

2017 |

94.26 |

69.74 |

47.77 |

7.80 |

219.57 |

||||

|

2018 |

87.88 |

63.64 |

54.15 |

0.43 |

206.10 |

||||

|

2019 |

82.04 |

59.53 |

61.93 |

35.49 |

238.99 |

||||

|

|

|

|

|

|

|

||||

(Source is from world platinum

investment council link here)

While south Africa is source of

approximately 70% of worlds platinum over the years from 2015 to 2018

production cost have varied from 1100$ to 800$ per ounce to produce.

Hypothetically metals prices

should not fall below production cost, so this makes a strong case for rise in

platinum prices from the current levels of 950$ per ounce.

Other factors are, in South

Africa labour constitutes 50 % of the mining cost and the labour union there

are demanding rise in wages.

For this same reason the platinum

production is expected to be reduced and as rhodium and palladium are by

products from platinum mining their prices have increased.

Whereas platinum prices have not

increased, the reason for such mismatch is because platinum like gold is held

in bar form in the reserves so there is enough reserves of platinum to

compensate any supply losses.

Another reason platinum has

underperformed gold is because that gold is considered as safe haven investment

whereas platinum is industrial metal.

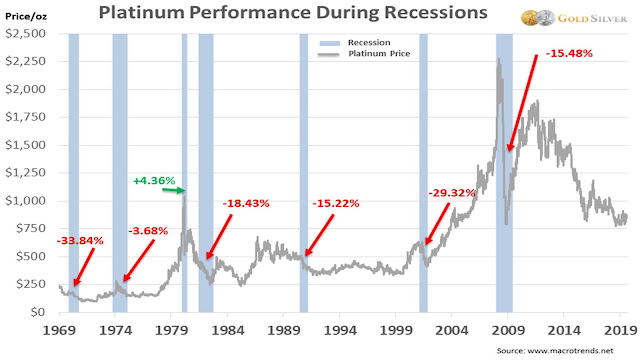

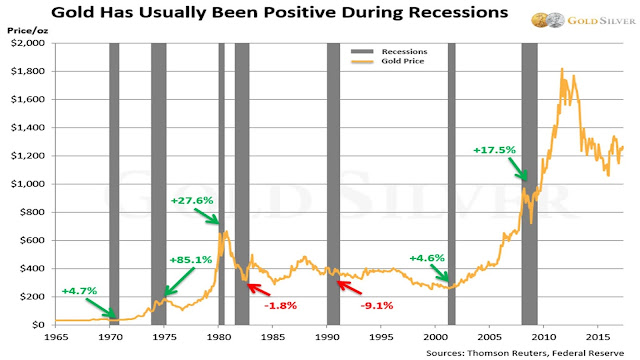

The graph here shows return of

gold during times of recession and return of platinum during same times.

Gold has performed well compared

to platinum at times of economic recession, as we can see from the graph below.

|

Also in 2020, recession due to

the pandemic has caused drop in demand from automotive sector, once the economy

start improving and auto sector starts performing well we may see platinum

prices rise again in the future.

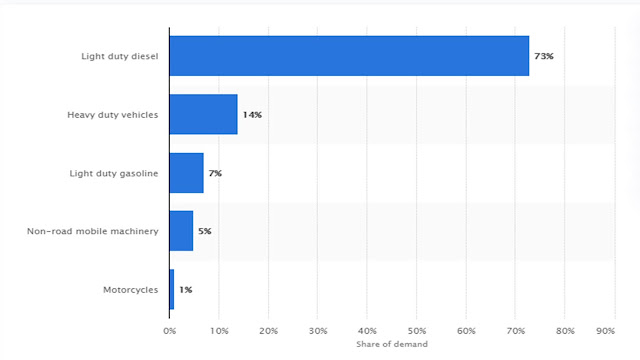

As we can see from the data that major use of platinum is used in catalytic converters of auto sector (catalytic converters:

these are used to convert harmful gasses into less harmful ones)

The argument

given for lack of platinum demand

going forward is that due to the current Electric vehicle revolution the use of

catalytic converters will vanish in the future. Hence the long term

fundamentals of the platinum looks weak.

Counter argument

given: platinum is mainly used in diesel

engine based vehicles.

As diesel creates pollution but offers better

mileage compared to petrol counterparts.

As we can see from the table.

Distribution

of the platinum demand for automobiles worldwide in 2017, by sector (source: Statista)

Most of the platinum is used in commercial vehicles

which are unlikely to be fully replaced by electric vehicles in next 10 years.

So we can be assured that for at least next 10 years the demand from catalytic

converters is going to stay.

Apart from that company called Anglo American which

is leader in platinum mining has stated that with more research and development

they are coming with varied uses of platinum.

One such example is that use of platinum in

hydrogen fuel cell technology, which has only one emission h2o

(water).

(People have

doubts over the use of hydrogen fuel cell over the lithium cell EV, but it’s suitable

for larger vehicles, hydrogen fuel and lithium ion technology are like diesel

and petrol of current world, however currently production of hydrogen is costly

making the technology inefficient)

This example is just to show that there could be

many innovations done using platinum.

Coming to jewellery

Why jewellery is made of gold or silver is because

of its property known as non-corrosion.

Just a fact: for the official definition of a kilogram the

cylinder used is made of platinum due to its non-corrosiveness property

Coming to jewellery as we can see from data in 2019

consumption of gold was 2122.6 MT and platinum was 59.53 MT.

Even if 10% of total golds jewellery demand shifts

towards platinum, then only the demand from jewellery can consume up the

current total supply of platinum and prices can be expected to trade at premium

to gold.

White gold jewellery which is 18 Karat, it has a

thin coating of rhodium (a member of platinum group metals) thus giving it

mirror like metallic shine, if we compare the colour both have same

colour.

But for platinum jewellery we can wear it in pure

and natural form, which preserves it colour, which wears off in white gold.

Also platinum is better for diamond studded jewellery.

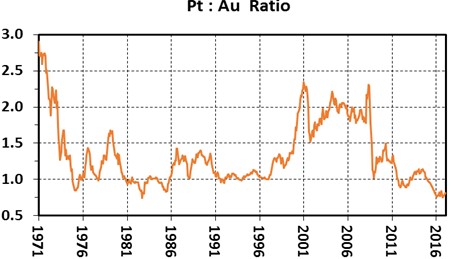

As we can see in this ‘ratio

graph’ that platinum has traded on an average at 1.5 times the value of gold.

It has been in significant

discount to gold 4 times over the last 40 years and each time it has risen

above the value of gold. It’s expected that this time as well the price would

at least match up the prices of gold.

Comparison on modes of investment in precious

metals

Investment in precious metal

|

GOLD

|

PLATINUM |

|

Online investment method

|

Online

investment method |

|

We can invest in gold using ETF's (Nippon gold

ETF trades at around Rs 47) |

In platinum we don’t have online option to invest

as of yet. Also on MCX derivative market we have gold and

silver but no platinum.

|

|

Also we can invest in using SGB' scheme by the government

(which earns interest of approx. 2.5% on nominal value)

|

There is a long way to go before online option to

invest in platinum are available in India.

|

|

Physical

bars: | Physical bars: |

Physical gold

bars can be counterfeited. |

Platinum is a special metal as its density is

even higher than that of gold, making it impossible to counterfeit this

metal.

|

|

How? In past there have been gold bars with tungsten

(density: 19.3 gram/cm3) inside them as these two metals share almost the

same density.

|

Compared to gold its density is 10% more and

hence if the metal is not real platinum |

|

The counterfeit gold cannot be identified even by

trained eyes.

|

We can easily find real platinum just by

observation, comparison and weighing the bar. |

With the above study it’s clear that, if one needs to invest in precious

metal then for

Physical

bars, platinum deserves a consideration over the gold.

And for

investing in gold, it’s better to invest through online modes.

Indian scenario gold v/s platinum

We can’t just buy gold and

platinum at international prices.

In India we have to pay various

taxes on them making it expensive to buy. So let’s check ground reality and

prices of each metals.

|

particulars |

GOLD |

Platinum |

|

1)

Price per ounce USD$ |

1930 |

892 |

|

2)

Price per 10 grams/INR (USD/INR

:73.53) |

45631 |

21089 |

|

3)

Levies and taxes |

15.5%

(refined gold) |

23.2% |

|

4)

Approx. prices |

52703 |

25982 |

|

5)

CMP (mcx) |

52,750 |

(N.A)

|

|

6)

Price on online stores |

55525

(link) |

29658

(link) |

|

Premium

to approx. prices (no.4) |

5.78% |

14.15% |

|

Premium

to pre-tax price (no.2) |

21.68% |

40.77% |

Well from the above table one can

understand that let the international price for platinum be below 900$ but the

actual buying cost is more than 40% costly.

Apart from this, if you wish to

sell your metal in case of emergency gold provides better buyback value ( if

24Karat) compared to platinum.

Clearly

future of platinum is bright but not for Indian investors.

Now this is dilemma

If we exclude Indian scenario

then, buyers of precious metals shall

prefer platinum jewellery and platinum bars over their gold counterparts.

But in India due to huge premium

on platinum prices, it makes platinum less attractive overall.

But still platinum trades at

50.74% discount to (approx. no.4) gold

prices. Thus even if it matches gold price it will outperform gold by 100% in

term of comparative returns.

Hopefully in next years to come liquidity and trading in platinum is enhanced, leading to better purchase and selling price

(click here to download PDF form of presentation.)

(This

is just a study to express my view on precious metal investing.)

PDF attachment.

ConversionConversion EmoticonEmoticon