Market anomalies = Investment Opportunities

Article published as on Wednesday, 17th December,

2021 at 5:00 p.m.

Few years back this situation existed where, in

Case of Mumbai local

The platform ticket was Rs. 5 and a journey ticket sold for Rs. 2

People who wanted platform ticket would instead buy a journey ticket. (naturally, a platform ticket offering less benefit should cost less, but that was not the case, so the people used to buy journey ticket instead)

Because these prices made no sense, then after someone the prices of the journey ticket were also raised. (I searched for any new article on this anomaly, but instead found this one. Link here)

Here in this case too platform ticket was being sold for Rs 50.

And a return journey ticket to nearest station was Rs. 10

People chose to buy return ticket instead.

Similarly, in the stock market also there are some anomalies.

(stocks trading less than their fair value)

which do create an investment opportunity

Currently there is an opportunity where we have stock trading at negative enterprise value.

|

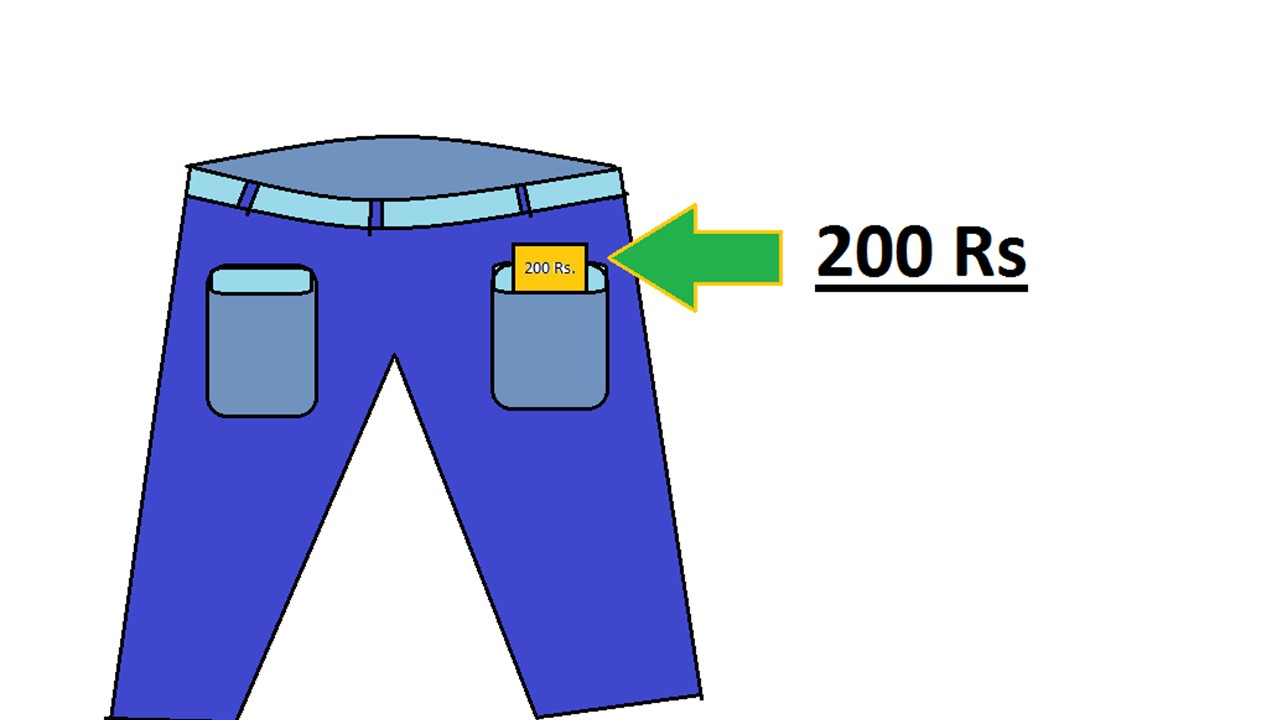

This image is from my previous posts, on Elnet tech and Selan exploration where such situation happened. it represent that for a price tag of Rs 200 you can buy a pant which has Rs 200 in its pocket. Essentially you pay Rs. 200 and get Rs. 200 back and you get to keep the pant for free.

Opportunity in Den networks:

It is currently trading around Rs 41.80

A bit of background on the company

In October of 2018, Reliance industries limited took over the company,

and Den networks allotted preferential shares at the price of 72.66 and raised

2,045 crores.

Fast forward to December of 2021.

The share price is Rs 41.80

And the amount of Cash and cash equivalents + liquid assets are over 2,440 crores.

Meaning on a per share basis it is approximately Rs 51.15

This company is debt free, and its core business generates positive

operating cash flows.

The logic for buying this stock is simple as depicted by the above

picture of Rs 200 in a pant.

Since the cash and cash equivalents are Rs 51.15 this shall be the

minimum level for the stock to trade, if not then there is an arbitrage

opportunity.

>Opportunities:

1)

Not a holding company: Den networks is not a

holding company where we shall assign a discount to the value of assets. Since

it holds Cash equivalents and liquid assets, if the management feels

appropriate then they can announce buyback of shares which would boost the

share prices.

2) Similar situation happened in 2 stocks: Elnet tech and Selan exploration, and there too after some time the stock prices were above their minimum level based on cash and liquid assets

>Risks:

1)

Not much return potential: from the current price

of Rs 41.80 the return potential is 22.25%, that too not guaranteed. (around 1

month back it was Rs 40.00) so the risk reward has deteriorated a little bit. Also,

stock may take many months before it actually reaches it optimal level.

2) The stock seems to have formed a bottom at 37-38 levels. But further decrease

in price is possible.

3)

Window dressing of accounts – example we had a

company named Cox and kings it was having lot of cash (As per the balance sheet

data) but subsequently went bankrupt. So, such risk does exist, in case of den

networks it seems relatively safer as we have Reliance industries as promoter

(who has good credibility) and also no debt on books.

Disclosures:

I do hold some share of Den network for tracking purpose.

Price = Rs 41.80 P/E ratio = 10.65

Market cap = 1,994.80 Crores P/B ratio = 0.69

ConversionConversion EmoticonEmoticon