INVESTORS DEMAND: Q&A

session with the management before IPO

Article published as on Monday, 28th June, 2021 at 7:00 a.m.

A parent asked a student who just finished writing an exam paper

Parent: "paper kaisa gaya?"

Student: "jaise aya waise chala gaya"

This can be experienced by some of the investors who invest in

IPO’s.

Companies come, get listed through IPO, and then disappear and

delist.

This is more common in the SME space as the regulation is less

and also thus risk is higher.

Let me share a recent case of the IPO Navoday enterprise ltd

Note: In the below example I intend to ask the questions and

clear my query from the point of view of an investor.

Navoday enterprise ltd

It came with a small-sized IPO of 4.61 crores on the BSE SME

platform (14th to 17th June)

With issue size of 23.04 lac shares and a lot size of 6000

shares.

Meaning only 384 lots are available for investors.

Business overview:

1) Marketing support and advertising services

2) Management and Financial consultancy services

3) Component supply and support services to manufacturers of

packing and allied machines.

As per the Draft red hearing prospectus (DRHP)

The IPO price means they are offering a company at a P/E ratio

of 2.75 and they have earned an ROE of more than 20% in these years.

Why did the merchant banker price

it at such low levels?

Either promoters are getting fooled or

Investors are getting fooled.

One surety is that one of them is getting fooled.

As per the MCA record, this company was registered on 10th

February 2018.

Financial metric of the company:

|

|

revenue |

PAT |

EPS |

ROE |

|

2018 |

23.1196 |

0.5567 |

3.59 |

39.94% |

|

2019 |

16.517 |

0.3507 |

2.26 |

20.10% |

|

2020 |

48.2724 |

1.1277 |

7.28 |

39.26% |

Suspicious thing is that in less than 2 months it generated a

revenue of 23+ crores and in the next full year only revenue of 16.52 crores.

When we google this company there is no for its website results,

only the IPO news is there.

The company website is mentioned in the DRHP Prospectus as http://www.navodayenterprise.com/

And when we find when this website was created the date is 9th

august-2020 meaning it’s less than a year old.

(I used this tool to check websites age click here )

Seems like they made a website particularly only to launch this

IPO.

Coming to the promoters of this company originally they had some

other promoters and then transferred stake to current promoters.

The current MD is Anand. V. Mode

Taking a salary of just 25,000 per month

Suspicious Independent directors

the independent directors are:

|

name |

DIN |

Age |

|

sachin S Garud |

8632025 |

25 |

|

Alka S Awhad |

8705251 |

36 |

|

Akash G Thorat |

8794854 |

31 |

|

Shamshuddin Ismail Polad |

8668466 |

54 |

No problem with the age and such young directors but their

remuneration for the year ended FY20 is zero.

“ yeh baat haazam nahi hui, daal mai kuch kala hai”

Why would these directors work for free is the question I ask?

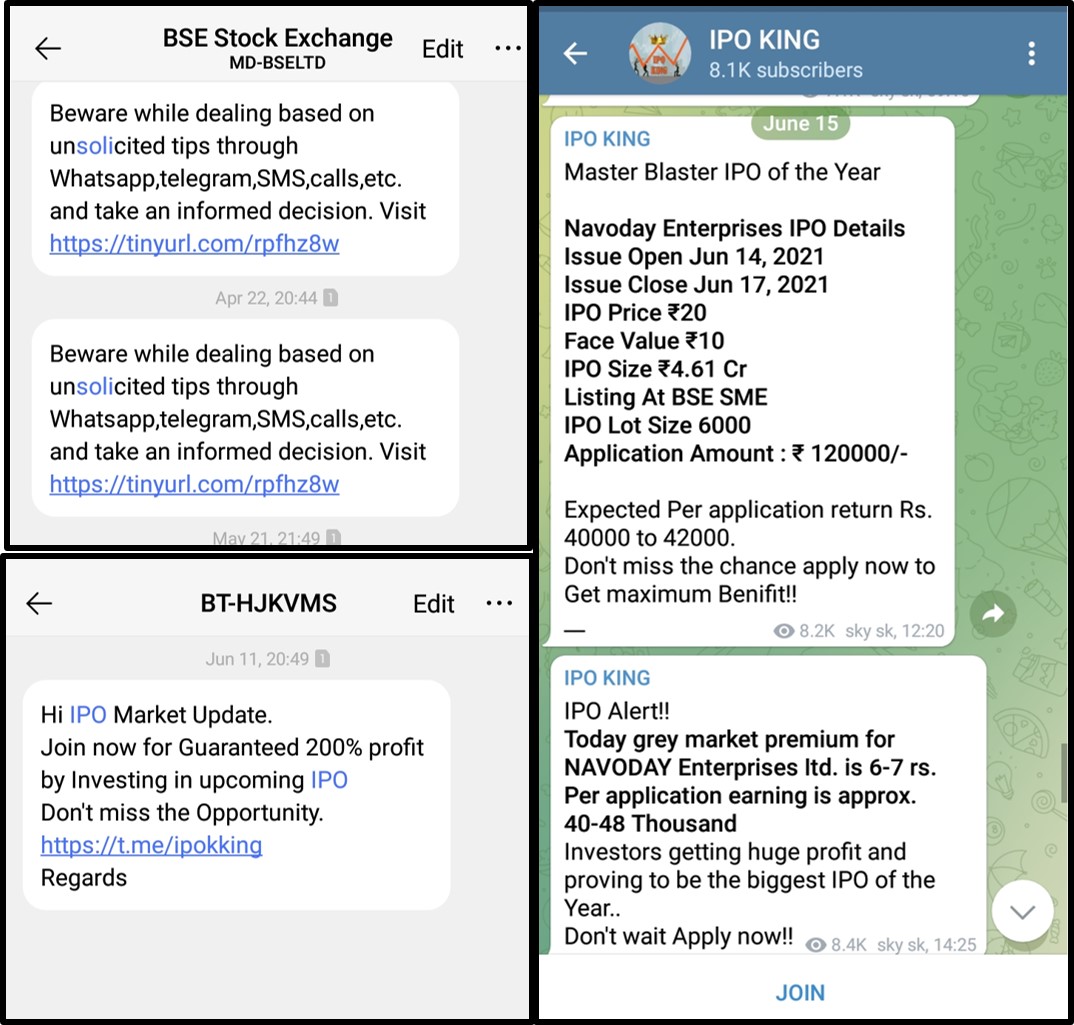

Unsolicited messages...

to join IPO King Telegram channel...

|

As a part of an investor awareness campaign, the BSE sends out

these messages to investors

But still, we get some messages.

Here the group was IPO King and it claimed to give information

on all the IPO’s

But unsurprisingly this was just propaganda as no other IPO’s

were discussed and the only recommendation to buy Navoday were pushed.

It claimed to have more than 14,000 buyers for Navoday in the

Grey market but in reality, not even 1000 lots were applied. Also, false hype

was being created for the IPO.

listing day result:

And finally, on the listing day of 25th June, it opened at

discount and only 3 lots were traded.

In the end:

4 crores may not be a big amount for the company but for

people who invest for them 1.2 lacs could be a huge amount.

To conclude I would say:

If there was a system where investors could have a Q&A

session with the management regarding IPO I would be so helpful.

Some companies do such concalls with investors before the IPO as a best practice of corporate governance. Along with red herring prospectus the interaction with the management is also needed to ensure investors are protected and not misled.

1 comments:

Click here for commentsJustice to small investors

ConversionConversion EmoticonEmoticon