IIFL securities: 10x in 10 years

Article published as on Wednesday, 11th November, 2020

at 5:30 p.m.

Flow of the

article

Explaining the flow

Introduction

About the

business

Demerger

Brokerage business

Land bank they have

AAA (advisor anytime anywhere)

Other business IIFL markets etc.

Financials

& Ratios

Valuations (using

DCF) and multiples like P/E and P/B.

Promoter and

Management analysis (very important)

So let’s begin:

Introduction

I searched on internet regarding IIFL securities,

but there aren’t many articles which can interest an investor.

Even the valuepickr forum has threads

about the old IIFL holdings but not of the demerged entities.

Today I want to present fundamental analysis of listed Indian FinTech stock which has potential to become 10x in 10 years,

Its IIFL

securities.

About the business

~Demerger

First of all let me provide details of demerger of

IIFL holdings

Record date for demerger 31st may 2019

Demerger ratio

For every 7 shares of IIFL holdings.

Investors will get

7 shares in IIFL finance

7 shares in IIFL securities

1 share in IIFL wealth

~Brokerage business

Let’s talk about the brokerage business

IIFL securities is a traditional brokerage house in

India, it has 2, 52,498 active clients as on the date (source: chittorgarh)

It has more than 2500 branches as on date.

(50-60 owned and rest are of sub brokers)

As any other traditional brokerage house it faces competition

from discount brokers.

Once IIFL holding promoted 5 paisa (now demerged) it

has 6 lac active clients and 3rd largest discount broker after Zerodha and

upstox.

Because of conflicting nature of both IIFL

Securities and 5 paisa they demerged but the management had an idea that there

is a huge market potential for discount broker and hence started the 5 paisa

venture.

However coming back to IIIFL securities

The brokerage business will be the cash cow for the

company, it will grow but not as fast as the discount brokers, if you look at

the historical income statements of IIFL securities you’ll see cyclicality in

it, as it’s the nature of the markets.

To counter this cyclicality they ventured into NBFC

business of wealth management and disbursing loans, through IIFL wealth and

IIFL finance, but they are now demerged entities, now they came up with the

idea of AAA to counter cyclicality of markets. (More on that further)

Pros: long established brand value and reputation in

the industry.

They are expensive but fully service oriented with

branches, research & advisors, RM’s, this also makes them profitable.

Cons: they have tough competition from discount

brokers,

They are not banking related brokerage

firm.

Coming to the

~land bank that IIFL security holds.

IIFL securities holds substantial real estate in

terms of office space which it rents out to its associate companies and earns

rent.

Its earning through rental income is approximately 55

crores annually

(As stated by management in recent con-call)

Buts its profitability is not good as major chunk

goes into the finance cost.

They

hold around 6, 34,459 square feet spread across multiple locations from

Ahmedabad to Mumbai to Pune. They are carrying it at book value of roughly

about 300 Crores and the market value is close to about 700 (source

link : concall of Q2 FY21)

Also the management plans to unlock value through

sale of its real estate, but they have to make debt payments against it as

well.

However in future they could post exceptional gains

when they sell some of their real estates.

Let’s see what AAA is about in short.

~AAA (Advisory

anytime anywhere)

I had seen many advertisements on TV but didn’t

paid much attention to it at first.

After doing a little bit of research I understood

that this is the 'FinTech' start-up kind of venture.

After all what PayTM has is a software which makes

it convenient for users to transfer cash to each other.

Similarly what AAA is: a technological software

which makes it extremely convenient for distributors to carry on business!

Its competitors are NJ India, and Funds

India wealth advisor.

They also provide software to distributors to

provide convenience in carrying out business and in turn take a share in

profits earned by distributor who uses their software.

Let’s see what the management had projected and

said regarding this venture.

R. Venkatraman :AAA is a tab

based order entry risk management back office for independent financial

advisors, including sub brokers, so this is one tool in which you can not only

do stock broking, but also buy mutual funds, buy insurance, debt products and it

has all encompassing comprehensive solution. ~concall 18th, May 2020

On the Concall in May2020 they said they have

roughly 1000 sub brokers using AAA.

In this article we can see that Nirmal Jain

chairman of IIFL said that

“Currently we are targeting

tier II and tier III cities, soon to make it multi-lingual with Gujarati and

Hindi in the coming months. We have invested nearly Rs. 100 crore and aspire to

sell 100,000 tablets in 2019 across more than 1000 IIFL centres. We are betting

on Jio’s growing network across India” (source link:

BFSI Economic times)

I am very excited because the growth potential from

this venture is tremendous.

This venture has the potential to add more sub

brokers in turn aiding the growth of traditional brokerage business as well as

growing its income from financial product distribution (FPD) as well.

Security broking currently contributes 67% of

income.

Advisory income and distribution of financial

products (FPD) contributes towards 13% of total income.

Other than that its real estate business contributes

to its revenue

and also the investment banking business which

undertakes IPO’s, FPO’s, QIP’s, rights issues, share buyback, advisory and

M&A also contributes to its revenue.

Let move to next part that is:

Financials and Ratio’s

As the demerger happened around May 2019 we don’t

separately have annual report for the company prior to FY2020’s

We will take the help of the investor presentation

to check its performance.

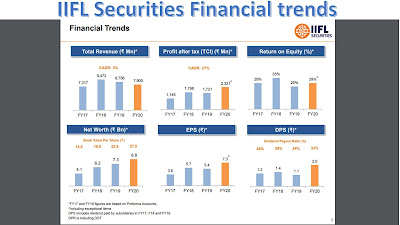

Here is the picture.

|

Here all the basic metrics such as growth of net worth,

earnings per share and dividend per share is given.

And also the return on equity (ROE) is given which

shows a consistent figure of more than 20 percentage.

ROE reflects quality of earnings: ability of

company’s business to generate super normal profits. This is the reason why

most High ROE companies trade at high P/E multiples

(But our IIFL securities is trading at single digit

P/E multiple)

Let’s move onto

Valuations part.

Let’s compare the IIFL securities with Motilal

Oswal and ICICI securities. (As on 6/11/20)

~Peer comparison

|

stocks |

stock price |

market cap |

P/E ratio |

P/B ratio |

ROE % |

|

ICICI securities |

454.15 |

14632.49 |

19.21 |

10.06 |

52.37 |

|

Motilal Oswal |

560.60 |

8169.59 |

32.77 |

2.79 |

8.51 |

|

IIFL securities |

38.70 |

1236.89 |

6.40 |

1.52 |

23.73 |

~valuation using DCF (Discounted cash flow model)

As seen compared to peers it’s one of the cheapest

stocks available,

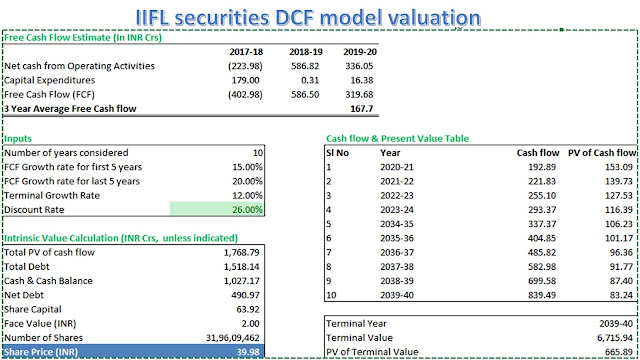

Let’s do the DFC (discounted cash flow) valuations

of the stock

(Now

obviously you could take different rates and the fair value would be higher or

lower, that’s why I have given all my figures and assumptions here)

In the picture you can see what assumptions we have

taken, and according to this the fair value as of today comes in the range of 39.98 to 50.37 rupees, for the current year FY 21.

And because the discounting rate is 26%, we can calculate fair value

after 10 years which comes in the range of 403.22 to 508.06 rupees.

In this manner I assume the stock to grow

10x in 10 years from the current levels.

Moving on to the next part

Promoters and management

I believe that however good the business and

valuations look prima facie,

It’s the management which matters the most.

Unfortunately it’s not simple task to do analysis

of management also this process is very time consuming,

So even my analysis could get updated with the

passage of time.

So Moving

on:

IIFL was promoted by Nirmal Jain (aged 53 as on

2020)

The promoters currently hold 29.8% shares

Fairflax currently holds 35.4% (they intend to be

passive financial investor)

During 1999 they decided to offer equity research

free of cost to public.

During 2000 IIFL launched 5 paisa per trade scheme

for its online retail customers. Retail customers needed to pay just 0.05%

instead of 1%-1.5% levied by other brokers. This helped IIFL gain a lot of

retail customers and also started a price war in the brokerage industry.

We’re talking about the year 2000. It was his

vision at that time and those disruptive tactics have worked well for IIFL

group.

(Source

link : for 1999 and 2000 year disruptions)

Years later his original concept of discount

broking got converted into 5 paisa company and are at no. 7 with 6,31,514

clients.

Later as the company grew they ventured out of only

brokerage business and started wealth management as well as disbursement of

loans such as housing, car loans, gold loans, they also became distributor of

financial products and started their own Mutual fund AMC.

~Fairflax

promoted by an Indian Prem wasta, who resides in Canada is known as Warren Buffet of Canada, he says that he invests in well managed companies with integrity and always takes a long term view of his investments.

Fairflax owns investment all over the world in India it also owns majority of Indian company Thomas cooks, It Also has major investment in Catholic Syrian Bank (CSB) and ICICI lombard as well.

Fairflax become the client of IIFL, later an

investor holding 9% stake in 2011 and later they went on to acquire more stake

through open offer, raising their stake to 35% in 2017.

Being a financial investor larger than promoters

gives investor a confidence that yes they have interest in wellbeing of the

company and will monitor the working and operations of the company closely.

Originally in 2005 they came up with an IPO giving

shares @ 74 rupees

They did a split (5:1) in 2008 now let’s take the

price of IIFL holdings in 2019 as 450 rupees.

This means the shares have multiplied your wealth

by 30 times in 14 years that comes to around 27.62% CAGR returns.

(That’s not even counting dividends)

From the above study it’s clear that management has

right intention and right vision to move ahead, there is big shareholder named

Fairflax to scrutinize everything and make sure that the level of corporate

governance remains high.

It’s certain that I don’t need to worry about the

intention of the management now even if company fails then it shall be business

failure,

And as we have studied they have their new FinTech

product ‘AAA’ ready, also the management is innovative and disruptive which

will certainly ensure survival of business.

Nirmal Jain has worked well and certainly created

wealth for shareholders, but the real question is:

~Will this innovation and growth sustain?

after all he is growing old. (His age 53 years)

Well at least for the next 10 years he would be

capable to actively handle and contribute towards the company so let’s not worry

for the next 10 years

~One more

study I would like to present:

On 13th march 2018 IIFL holdings made a

high of 874 Rupees

And if we compare same demerged shares their value

is (as on 6/11/20)

IIFL sec (38.60 Rs)

+ IIFL finance (84.75 Rs)

+ IIFL wealth (908.75 *(1/7) Rs = 129.82 Rs)

=253.17 rupees

This comes to around 253.17 Rs which is 71.03

% discount from its peak, while the business & profits have only

grown since March 2018.

This according to me is value investing in real

terms.

Conclusion:

From what we have studied I conclude that

1)

We don’t

need to worry about the intention and integrity of management, they seem to

have good track record and background.

2)

The company

is innovating constantly, which is essential for survival, also the venturing

into FinTech space through ‘AAA’ seems promising, so business prospects looks

bright.

3)

Very good

financial performance and ratios, as mentioned constant high ROE which was

above 20% and a good Dividend pay-out ratio.

4)

It is such a

brand and well known B2C business which every reader must have at least heard off,

thus establishing brand value and reputation of this company.

You will find many such fantastic companies but the

main point to focus is valuation.

All other such quality companies will be trading at

high valuations BUT IIFL securities is trading at a P/E multiple of just around

7.

With a combination of

Good management+ bright business prospects+ cheap

valuations

One should definitely not ignore investment

opportunity in IIFL securities.

I would repeat this thing again

In IIFL security multibagger gains could be generated, it has

potential to become 10x in 10 years.

Scrip code: 542773 market cap: 1236.89 crores

Stock price 38.70 eps: 6.05 rupees

(Disclaimer: I hold small quantity, and would like to read your views,

questions on this research so comment down below, what do you think?)

4 comments

Click here for commentsWow...what a good in dept analysis. Much appreciated!!!

ReplyKeep the Good Work.

Thanks

Suchit

Good one. What about IIFL? Will that become a multibagger?

ReplySir, IIFL security looks promising, other iifl companies are also well managed, but i havent studied their business model in depth.anyways if managements is good then let them worry about shareholder wealth creation you just be relaxed.

ReplyCompelling investment idea from IIFL Securities! Your vision of achieving 10x growth in 10 years is both ambitious and inspiring. Impressive perspective! if you're interested in details on list of top 10 stock advisory company in india, feel free to explore more.

ReplyConversionConversion EmoticonEmoticon