The bubble

of HUL

Article published as on Saturday, 10th October,

2020 at 1:00 p.m.

Introduction

Does Hindustan unilever (HUL) share deserve the

current valuations?

Would HUL share price underperform in coming years?

While I was reading I came across articles stating

how ITC could be better than HUL, so I did my own research to confirm this and

here it is.

Flow of the article

>Introduction

>Explaining flow

>PE ratios and financial data of companies.

>Using DCF valuation method (no calculations

only figures)

>COE (cost of equity) better than return on equity and flaws of current methodology of calculation.

>Finding value through this new method.

>Comparing HUL with global counterparts in terms

valuations.

>Conclusion

Let me provide my case and research to you

PE ratios

and financial data of companies.

Hindustan unilever’s PE is high.... (Compared to index)

[Stock price /PE (TTM)]

HUL 2138.85 /73.21

Dmart 2057.65 /125.26

Verses

(Benchmark)

SENSEX 40509.49 /23.32

ITC ltd 167.85 /14.42

RVNL 18.70 /4.98

(Rail vikas nigam ltd)

Let’s check

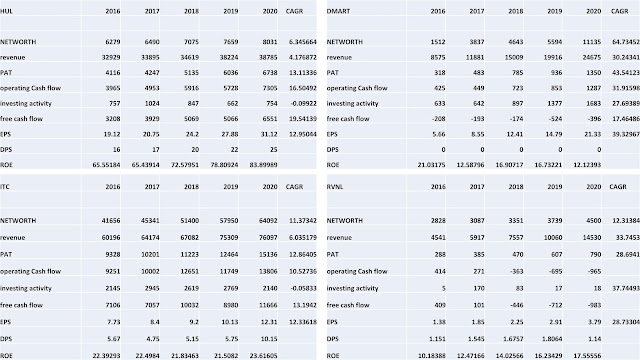

the growth rate of all these companies in last 5 years.

After gathering data

Using DCF valuation

method

For

Fair value for HUL 785

rupees/-

Fair value for ITC

179 rupees/-

We can use DCF only for positive free cash flow

companies such as ITC and HUL.

(For dmart and rvnl they are using capital for

growth hence we currently won’t be using DCF for them)

As we can see I had taken 19.54% growth for HUL (on

a higher side)

And 13.19% growth for ITC.

These valuation is for getting 15% return on equity

(discounting rate taken as 15%)

And the results are before you.

Better thing

to use instead of ROE could be COE

The formula for ROE

1) ROE = net earnings (PAT)/ average shareholders’ equity

(net worth)

Return on equity is the amount the book equity

generates as net profits

(Here calculations are made on net worth which can

be misleading, example given below)

Interesting Example: Suppose I BUY a debt security for rupees 100

which yields me 7% rate of return I write off 93 rupees in my books and show

its value as 7 rupees of debt security which yields me 7 rupees.

I would say Look at this wonderful security earning

100% ROE, buy this 70 times P/E (490 rupees)

This way I quote 100 rupees of fair value of debt

security for 490 rupees.

Problem here is that I cannot reinvest that 7

rupees interest for same 100% return.

This is what

is happening in Hindustan Unilever

Some people say ‘OH look at its incredible high

Return on equity!’

But the problem is that HUL cannot reinvest that

money to get compounding growth effect.

Now ROE can be misleading instead lets understand

what is it and how to calculate cost of equity

Cost of

equity for investor is the rate of

return s/he expects on investment, for the company it is the cost of raising

fund through equity.

It is much more dynamic in nature due to its

flexible formula.

Cost of equity= risk free rate of return+ premium

expected for risk

1) COE= (Dividend/ share price) + growth

2) COE= (Earnings/share price) + growth

COE for all the companies are as follows based on their

share price

(As on

9/10/20)

Stocks share price/ Cost of equity

HUL 2138.85 /1.3659 %

Dmart 2057.65 /0.7983 %

ITC ltd 167.85 /6.9348 %

RVNL 18.70 /20.0803

%

Now lower the COE, the more attractive for company

to raise funds using equity dilution.

And higher the COE, the more attractive for company

to buy back its shares

From the data it’s evident that HUL pays out major

portion of its EPS as dividends and is not able to reinvest in its business. So

despite having such low COE it won’t be taking advantage of this phenomenon

For this dividend pay-outs let’s take it as ‘interest

from fixed income security’ and calculate its fair value.

Five year forward dividend is expected to be 45.95 [25*(1.1295^5)]

assuming 6% yielding debt security (10 year G-sec

yield is around 6%) it comes to around 766 rupees.

Counter argument:

If HUL is high PE stock, then other FMCG

companies also trade at high PE then are they overvalued too?

We can’t be using this formula for all FMCG

companies as not all of them pay all of their income as dividend.

This is the

#1 reason why I feel HUL is overvalued.

Because it pays almost all its income as dividend

and is not able to reinvest into its business.

Some People suggest that it has high growing

business.

Just because PE is high people will try to justify

it by saying high growth business.

It has growth, but other companies are also growing

which are available at reasonable valuations.

Another

interesting study comping HULS valuations to its global peers:

Let’s compare at what valuations do its global peer’s

trade at?

(Stock price (currency) P/E)

Hindustan unilever 2138.85

INR/ 73.21

Unilever (UK) 4847

GBX/ 23.73 P/E

Unilever Pakistan foods ltd 15000 PKR/ 29.12 P/E

Glaxo smithKline Bangladesh ltd 2174.90 BDT/ 29.12

P/E

(GSK Bangladesh is taken because just like in India

GSK sold its business to HUL in share swap transaction, similarly in Bangladesh

also its business is under process of being sold to Unilever, hence it is taken

for comparison)

Now as we see among all the Unilever’s our Hindustan

Unilever is trading at much higher premium.

One may argue that geography, market

size and opportunity is different…

Well this is just a broad comparison which we have

to take with a pinch of salt.

And for people interested, they should dig deeper

whether Hindustan unilever really is growing faster than its Pakistani and Bangladeshi

counterpart.

As a matter of fact I just checked the data of year

ending 31st Dec 2015 and 2019 and saw that Unilever Pakistan foods

ltd has grown faster than its Indian counterpart yet its trading at cheaper

valuations…

🙋Now someone will try to bring in inflation point of

view into it

🤣🤣😂😂😆😆 Enough of analysis!!!

I will leave it to you, Comment down to share your

thoughts on it

Conclusion

>I have repeated several times and once again I would

repeat that HUL seems overvalued because

it’s not reinvesting into its business and giving almost all of its income

as dividend.

>I am buying High P/E stocks for growth and not

just dividend otherwise I would be better off owning stock like PFC, REC

>In the long term stock prices corrects towards their

fair value/ intrinsic value

>There was a time when HUL did not move for

years and suddenly a spurt came and made investor’s wealthy

>Currently price of ITC is similar to what

it was 8 years ago.

>So in the next 10 years it’s more likely that HUL will underperform ITC*

*ITC is just taken for comparison with HUL there

are other growth oriented stocks such as dmart and RVNL (psu) and many more

which could outperform the returns of Hindustan Unilever (HUL)

(Disclosure: I don’t own HUL or ITC, they seemed an interesting case to me, and I have just presented my viewpoints here.)

ConversionConversion EmoticonEmoticon