IDFC first bank AGM 2020

Article published as on Friday, 31st

July, 2020 at 8:00 a.m.

30/7/20 Thursday, 11:00a.m

The

AGM was started with Satish Gaikwad and then V. Vaidyanathan afterwards a

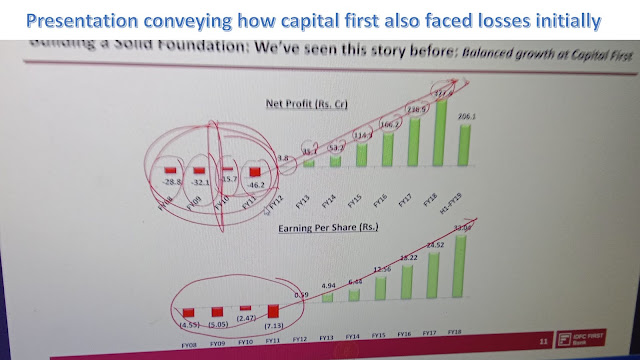

presentation was shown, Mr. Vaidyanathan showed the presentation why the bank

posted continuous loses quarter after quarter and also showed the graph of

performance of capital first attached below, indicating IDFC first bank may

also start like this with losses and negligible profits and then compounding

profits.

V.

Vaidyanathan asked shareholder to be candid and ask all their queries in a

straight forward manner. Even I asked my questions and was answered

subsequently, lastly Vaidyanathan gave chance to other managerial personnel’s

to say a few words as well.

The

AGM was not as good (conducted on cisco WebEx) lots of technical difficulties.

Let’s begin with the highlights

and key points of the AGM.

Presentation by management:

This

graph in the picture shows initial years of capital first and even after joining

by Vaidyanathan the company posted losses for 2 years. He was trying to convey

that even in IDFC first bank the time is tough and losses are being posted, the

bank has used this time to strengthen itself and build a solid base for

fantastic growth. He also indicated that investors shall maintain patience as

good time is yet to come for IDFC first bank.

Mr. V. Vaidyanathan clarified

that he sold his shares recently at lower prices to avoid margin calls.

He

explained the story how he took debt to buy shares and when the price were

going down he had to sell just to prevent margin call and clear off debt. He

has learned the lesson not to leverage which could result in forced selling

Comments on Morgan Stanley’s

target of rs10 ( this

link says rs.15)

He

assured that the analyst have provided their opinion and this does not factor

in the strong base and excellent corporate governance of IDFC first bank.

Also

he has never called Morgan Stanley to talk about such reports and ask why the

low target was given

Mr.

Vaidyanathan was very confident in the bank and even said that Morgan Stanley

would themselves one day upgrade the price target of IDFC first bank much

higher than the price today.

Won’t open a twitter account

The

CEO was asked to create twitter account as it would help better connect with

people, he replied he is not interested as he feels social media would take a

lot of his time, and it won’t be possible to read/reply every comments.

Security first policy. The bank

has focused on creating very high level of security for depositors, one may

think they are offering high interest rates so they may be risky, but their

agenda is very clear, Safety first. Seeing the confidence of management even I would

recommend people to avail the benefits of 6% to 7% interest rates, but if

someone asked shall I invest in shares, I would be neutral as this company has

disappointed investors (not destructed wealth, but has not created wealth

either) I would wait for performance in upcoming results. Also they said they

will continue the higher interest rates for some time.

Talks

and discussions on reverse merger with IDFC ltd were also discussed, it may or

may not happens, so the possibilities are open.

Apart from this the management

sounded very confident of the future of the bank,

The

live OaVM meeting started at 11:00 a.m. and ended at 2:30 p.m. lasting 3 hours

30 minutes.

Conclusion/ my understanding

The

management is very professional, conservative (a bit too conservative in fact),

confident for future growth.

After

many quarters we have seen some profits of the books of accounts giving us

(investors) a ray of hope that yes now the profits will start compounding from

here on. (Can’t be sure about it, will have to wait few more quarters and observes

developments)

Also

if some news of reverse merger comes in near future, I would like to be

invested in IDFC ltd (its parent and holding company)

Final comment: I feel currently it’s better to open savings

account and earn 6% rather than investing into equity of this bank, as an

investor we have been disappointed, I personally would like to observe few more

quarters of performance.

Stock code:

IDFCFIRSTB

Price: 27.00 Rs.

Market cap: 15315.33 (crores)

2 comments

Click here for commentsWhat was his answer for huge capital size of the bank and IDFC LTD wanting to sell its stake?

ReplyHe explained that huge capital size should not be something to worry about, and relating to stake sale by Idfc ltd what i understood was that, parent is supposed to maintain 40% stake in bank from 5 years of obtaining license. Now this term is ending in october 2020, also the idfc ltd has most probably took debt to invest in shares of idfc first bank, now after the 1st oct 2020, idfc ltd would most probably sell some of the shares to clear of the debt it had taken to invest in shares. Its upto idfc ltd management to decide what to do ultimately.

ReplyConversionConversion EmoticonEmoticon