|

| Elnet tech IT park |

Article published as on Tuesday, 11th

April, 2020 at 7:48 p.m.

Have

you ever come across any stock with negative enterprise value?

What do we mean by Enterprise Value

(EV)?

Enterprise value is the value used to

acquire whole company considering you have to pay off debts and get cash on its

books.

This is sometimes more preferred as it

takes into account both cash and debt component of the company and gives a

holistic view.

Formula

EV = Market cap + Debt - Cash

equivalents.

In other words when Cash equivalents

are greater than the Debt Component and the Market Cap of any Company it is

known to be Negative Enterprise Value, means you have more than what you value

or pay for.

Considering these conditions and

parameters can you guess or name any such company which has a Negative

Enterprise Value?

Friends here is one, Elnet tech!

(listed only on BSE)

Q) What does it do?

A) It is in the business of renting out

Office spaces through its owned Building in Chennai, It is set up by Tamil Nadu

Government, known as IT park (similar to Nesco), which was built in 2000's to

promote IT development in the state.

Its primary source of earning is rental

income and expenditure is maintenance of building the balance left is net

profit!

Revenue - 21.04 crores (FY18-19

figures)

Net profit -8.41 crores (FY18-19

figures)

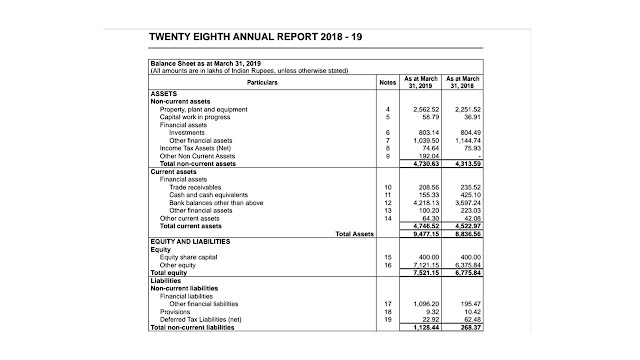

Now as per a financials

Let’s calculate our components of the formula.

Year 2018-19 figures are (figures in

lakh INR)

.

|

|

| financials of Elnet tech |

(1) Cash

and cash equivalents (liquid assets)

Non-current investments

|

|

Financial assets

|

|

investments

|

803.14

|

Other financial investments

|

1039.50

|

(These are liquid investments in shares and mutual funds

respectively, just classified under non-current assets.)

Current assets

|

|

Cash

and cash equivalents

|

155.33

|

Bank

account

|

4218.13

|

Other

financial asset

|

100.20

|

(2)Debt

-

Debt

|

1096.20

|

(3)Now market cap as on 8-April-2020

Equity Capital: INR 4 Crore (40,00,007 Eq. Shares of Rs.10/- Face

Value)

Share price – INR 90.

Market cap INR 36 Crores.

Let’s find Enterprise value now

EV = Market cap + Debt - Cash equivalents.

EV = 3600

+1096.20 - 6316.30

EV = -1620.1 (lakhs INR)

(One can get slightly different values based on minor inclusions and

exclusions)

There you have it!! Isn’t it amazing!?

Let’s understand this situation with an example.

Suppose you go for shopping and see a jeans for INR 200.

And you know there is 200 INR, in its pocket?

Wouldn’t you be amazed at such a deal?

You get jeans with Rs.200 of cash in

its pocket, just for INR.200!?

|

| INR200 in a Jeans. |

Some

quick FAQ's!

Q) Why is

there debt of 10.96 crores if it has so much of cash?

A) If you

know system of rental business, the landlord takes security deposit, same in

this case also Elnet tech is just taking security deposit as a precaution, its

common practice so nothing to worry about.

Q) How

could it be possible? Maybe it’s just a paper company or its accounts are

cooked?

A) Well

it is a kind of a Semi-PSU, since 26% stake in it is owned by Tamil Nadu

Government through its holding Company ELCOT, so it’s a real company with real

assets, only thing is people are not aware about this company.

Q) If

this company has so much assets and its cash rich why isn’t share price not

increasing?

A) There

are many reasons, few of them are:

1)

People are unaware of this company.

2)

There is limited scope of value unlocking.

Q) Is

value unlocking possible in future?

A) Value

unlocking has not happened till now, maybe with the help of activism it would

be possible in the future!

Yes! It

is amazing but as you have read these FAQ's you would know that following

factors contribute towards negative enterprise value.

· It

has passive business of just rental collection.

·

Value unlocking is difficult.

· Lack

of awareness is what is causing depressed share price.

Few big

positives are, they are generating massive operating cash flow.

It has lease hold land for 90 years starting from 14-January-1999. For which prepayment of 90 years is made in advance.

Plus as

mentioned they have massive cash reserves only on a market cap of 36 crores.

Well

let’s see if any value unlocking takes place in the future.

(Disclaimer-this are my views based on my research and study, and

not necessarily a recommendation)

ConversionConversion EmoticonEmoticon