Cesc ventures, an interesting holding company.

Article published as on Saturday, 21st

April, 2020 at 10:30 a.m.

Cesc ventures came to be known in its form after the demerger of

CESC (Calcutta Electric Supply Corporation , record date 31/10/2018) into Cesc, Spencer retail and Cesc

ventures.

It got listed around 600 INR. And went further down now towards

150 INR.

Before starting fundamental analysis, let’s first find out what

went wrong? Why it fell from 600 INR to 150 INR.

After doing my research I found something interesting.

As Cesc was a large cap category company, mutual funds were

holding more than 20% stake in the company.

After demerger when Cesc ventures was listed it was categorised

into small cap company.

Due to this very reason many mutual fund offloaded shares of Cesc

ventures in order to comply with SEBI guidelines of fund categorisation.

So this thing makes it clear that there was no management or

corporate governance issue in this company and due to SEBI laws, mutual fund

had to sell shares and this caused a downside from 600 to 150.

Now as we understood why the share price tumbled one thing is

clear mutual funds had to sell to comply with the rules, let’s focus on Fundamental analysis:

Share price 150 INR (approx. as on 18/4/20)

Market cap 397.67 crores

Cesc ventures is from RP-Sanjiv Goenka group, a reputed group.

From the interviews Sanjiv goenka he looks quite an aggressive

businessman, in the interviews we also come to know that they have hired

professionals to run each business, which is another encouraging point.

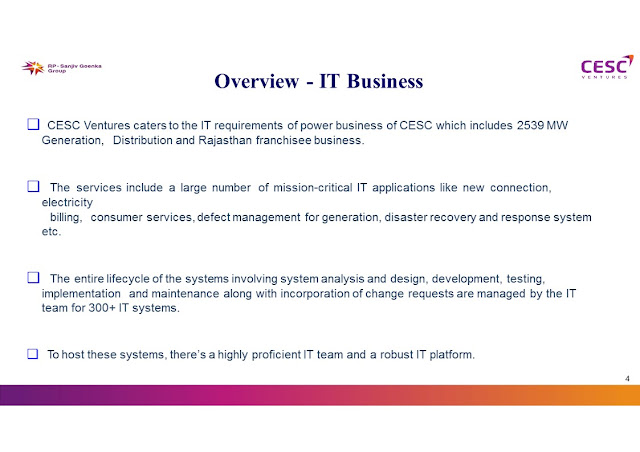

Cesc ventures caters to IT requirements of power business of Cesc

ltd .

They provide services such as

Billing service, customer relationship service, new connection

system, engineering asset management, treasury management system and

performance management system.

They earned ( figures in INR crores)

EBITDA. 74

PAT. 66

Through their own IT business.

Cesc ventures is investing in many start-ups which can deliver

high growth in value in future.

We will talk about such start-ups and its investment, going

forward.

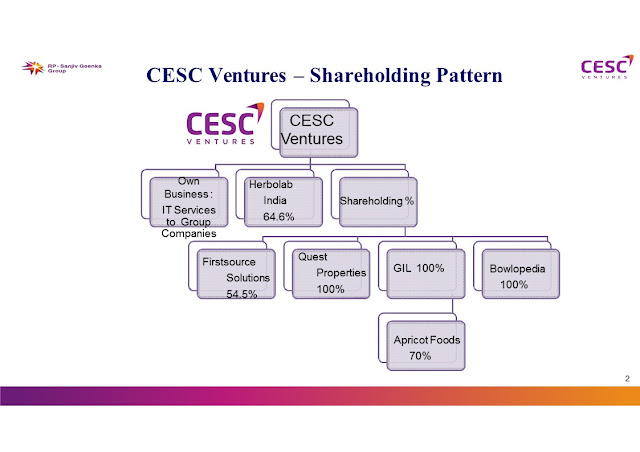

Here is a graphical representation

First source solution - it is among

top 3 pure play BPO in India. It is planning to venture into new segments like

digital and automation.

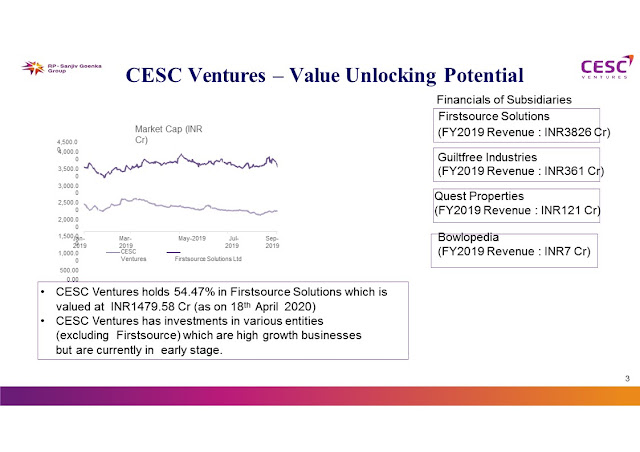

Let’s start with its stake in first source solution

54.5% stake in first source solution @ 39 INR per share translates

to the value of holding value of 1480 crores.

Now the interesting thing is that on 28th February it received 97

crores of rupees as dividend from first source solution.

Only taking Cesc ventures as proxy play to first source solution

makes a holding company discount of 72.5%

This helps making Cesc ventures very defensive.

Moving to

its FMCG business.

BEST

thing is that they are expanding by not taking debt, but organically this is

all possible due to their cash generation from other business and dividends

from first source.

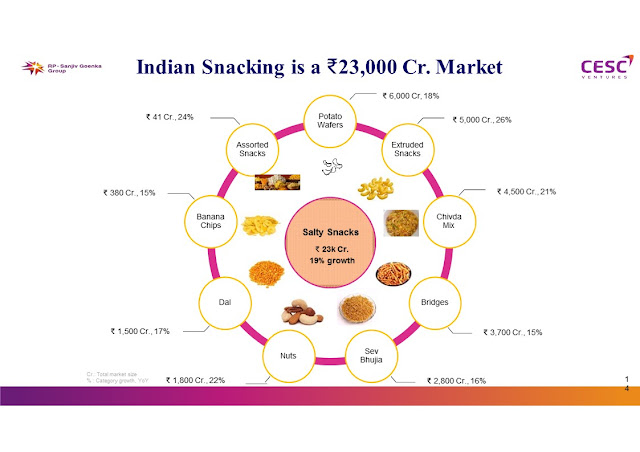

Why this

segment excites me is because Sanjiv Goenka spoke about vision of 10,000 crores

of revenue from FMCG in 5 years.

Let’s

learn about too yum- it is a brand owned by Guiltfree industries started in

April 2017. And has been estimated to grow 600 crore turnover company in

FY2019-20

(Actual

figures may vary from these estimates)

What is

exciting is that the professional management team has managed such a run rate

in just 3 years. Having brand ambassador such as Virat Kohli who strictly

promotes healthy snacking.

They have

said to breakeven in this business around June 2020. Which is a positive sign

and we may see positive EBITDA from FY21 onwards.

Looking

at confidence of management and their style of expanding without taking debt is

very fascinating.

(anyone who has tasted too yum products will surely agree that they produce some of the best and unique flavors in packaged snacking)

They also own 70% in apricot foods pvt ltd which is a regional player in

the state of Gujarat, they can leverage this business also going forward.

Coming to another important business

Located at a prime location of Kolkata, they have more than 4,15,000 sq.

ft of retail area. And capacity of 900+

car parking.

They collect rentals by leasing premises.

EBITDA 55 crores.

PAT 20 crores.

They also have residency projects going on at Haldia.

Apart from that they also own some land bank at BKC in Mumbai.

(need to do some research on this part)

Now Quick Service

Restaurants. (QSR’s)

They own QSR through Bowlopedia restaurants India ltd

Cesc ventures owns QSR like

Waffle wallah and Bombay toastee.

These are currently into losses right now, they may take time to

be profitable.

Lastly these are various

investments by Cesc ventures through RPSG ventures.

(They have minority stake from 8%-40%)

Herbolab India- having 64.63 %

stake Manufacture and sale of Ayurvedic proprietary medicines under the

brand name of “Dr. Vaidya’s” has 100+ ministry of AYUSH (FDA) formulations for

medicines/products.

ShopG - Operates a Social

commerce platform focused on providing discounted deals to

customers for FMCG products, led by influencers

M caffeine- Offers Caffeine

infused personal care products selling through own website and

online marketplace

The souled store -Designs,

manufactures and sells licensed fan merchandise across

several product categories (T-shirts, jackets, accessories,

phone covers etc.

Peel-Works Private Limited -

('Peel-Works') is a technology driven Distribution Company which supplies

goods (food, grocery and consumer products) to retailers and

wholesalers where orders are collected through a software application.

These are very exciting investments made by Cesc ventures. They

are in initial phase of growth but may grow big in future. Here Cesc ventures

are trying to be venture capitalist.

Conclusion:

· Main focus for me

is that they are into fast growing FMCG

business with huge visions.

· Professional

management, and their ability to build Too YUM a 600 crore brand in just a span

of 3 year. And still have huge plans for its growth

·

(disclaimer- one should do his/her own research before taking any call)

To

counter their aggressive style, we also have holdings of first source solution

which is defensive and provides comfort.

· It

is trading at huge discount of 72.5% from its holding value in first source

solution

· It has

investment in various high growth start-ups, for which we have to trust the

judgement of the management.

(click here for the link of

December 2019 presentation)

(disclaimer- one should do his/her own research before taking any call)

ConversionConversion EmoticonEmoticon